SaaS solutions are some of the fastest-growing segments in IT. An increasing number of organizations are embracing the model at scale, and the reasons are not far-fetched. Besides the neat subscription model and central location on a remote cloud network, flexibility and affordability are two reasons SaaS has really taken off.

Beyond engaging the model, a SaaS business needs a framework for long-term growth. After initial users, it’s necessary to accelerate growth. Some companies begin by funneling cash towards user acquisition, but new users may discontinue using the service. It’s, therefore, essential to retain users and grow the Customer Lifetime Value or LTV metric.

The LTV is one out of a plethora of essential metrics connected to the SaaS industry. Metrics are like troops in battle; it’s the commander’s job to lay them out in the most efficient way possible and win in the face of competent competition.

Traditional growth strategies are often less than effective in an agile software industry like SaaS. For this reason, concepts such as customer lifetime value, customer retention, and revenue churn are increasingly crucial. SaaS growth depends on looking at operations with non-traditional lenses like these metrics.

Growth is only possible by understanding these metrics and applying them in ingenious ways to your SaaS product and business. This guide introduces 10 top SaaS metrics to pay attention to and grow your business.

“We often say if you have traction, lead with traction. Talk about specific customers, usage numbers, revenue metrics – anything like that that really is clearly explicit and factual. Get that out in front early.”

Dave McClure

Here’s an outline of what this guide covers:

- Introduction

- What are SaaS Metrics?

- Why Growth Matters and an Approach that Works for You

- Which SaaS Metrics Should You Pay Attention To?

- Customer Churn

- Revenue Churn

- Activation Rate

- Burn Rate

- Customer Lifetime Value (CLV)

- Customers Acquisition Cost (CAC)

- Monthly Recurring Revenue (MRR)

- Annual Recurring Revenue (ARR)

- Net Promoter Score (NPS)

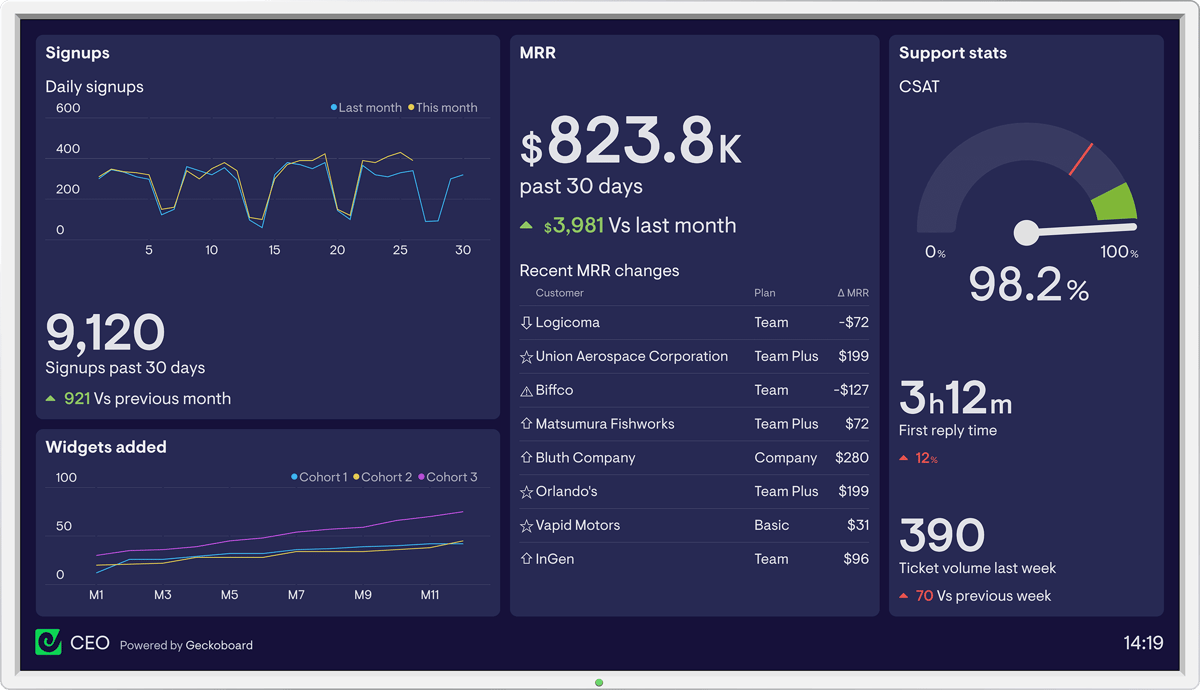

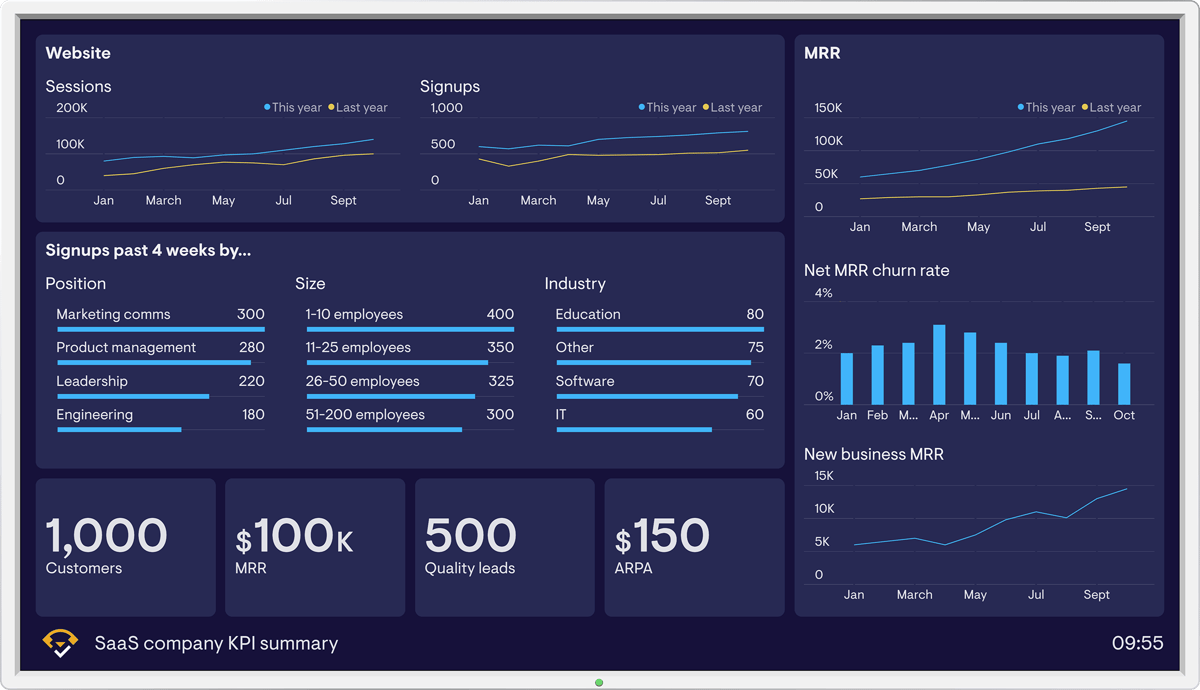

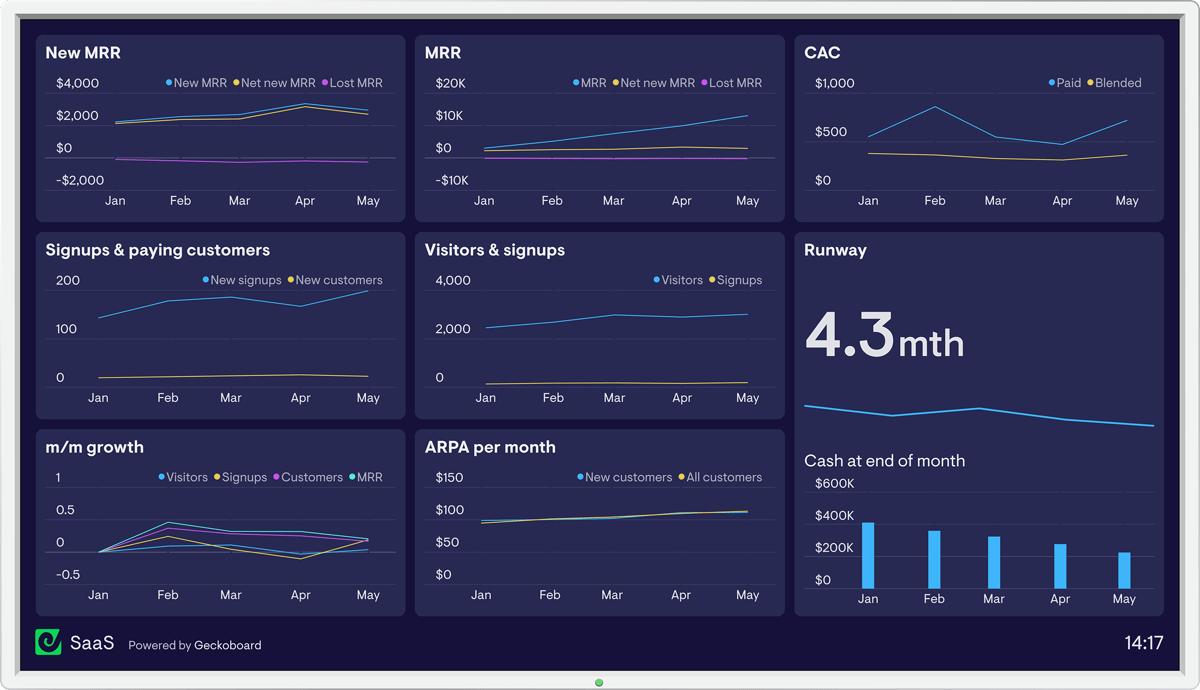

- Examples of SaaS Metrics Dashboards

- Best Practices for SaaS Growth

- Conclusion

What are SaaS Metrics?

SaaS metrics are simply benchmarks. Companies use these benchmarks to ensure that they achieve steady growth.

But isn’t that what Key Performance Indicators (KPIs) do? Yes, but SaaS metrics can tell you if your business is actually making money or burning through it like a raging inferno.

With SaaS metrics, you can prepare your company to enjoy a stable economic future. That’s exactly what companies such as Salesforce and Marketo have done, and the rest of us can only envy their continuous steady growth. Or at least, enjoy the excellent products they offer us.

Why Growth Matters and an Approach that Works for You

Growth is a significant challenge for companies. Though you might have a shrewd growth template at launch, it takes far more than spreadsheets to leverage viral spikes for sustained growth.

A qualitative growth model is essential to guide the strategy that’ll eventually give you buy-in from your people and investors.

That said, there’s no standard template for growth in SaaS companies. But, high-growth SaaS companies have used a set of features to achieve their enviable status.

1. Adopt customer success

Customer success is indispensable in SaaS. There are various ways to adapt it, including developing a value or philosophy, strategy, business unit, or department.

Success in SaaS depends on being customer-centric. Your company can build relationships with customers to the point that it becomes a competitive advantage. Retaining customers over the long term is essential for a business whose revenue base is recurring revenue.

The primary benefits of customer success include:

- Customer retention

Retaining customers ensures growth in recurring revenue from subscription renewals. Customer success is mainly the result of implementing SaaS strategies to help end-users benefit from your product and stick with you.

- Business expansion

Business expansion exposes your brand to other revenue sources such as upgrades, cross-sells, or multichannel selling. Your product management team needs to up their game to continually upgrade products and add more value to customers while generating much-need business.

- Brand advocacy

Upon experiencing much success in retaining customer loyalty, the next logical stage is to nurture them into brand advocates. It will attract more prospects to the sales funnel and lead to effective marketing without any spending.

2. Build a strong network of viable partners

A key growth strategy is to create a strong network of channel partners while developing your tech marketing strategies.

These partners are not your competitors but operate in a similar niche to help you increase your customer base. It’s essential to define the product-market fit, though, before working with channel partners.

The right partners are at the correct growth stage and in a suitable market segment relevant to you. It’s best to avoid those whose solutions will be a mismatch with yours.

The best partnerships are symbiotic, mutually benefiting both parties. It might be a simple sharing of revenue or providing a free product subscription to them. Ensure you iron out the cost(s) of making them a channel partner in the initial stage so that the partnership is viable from the onset.

3. Let your product lead your growth

Product-led growth is a proven high-growth SaaS strategy. It enables you to position your product as the primary driver of your entire business growth.

Identifying the growth levers within your product and offering your customers proper engagement channels contribute to product-led growth. The freemium model is one way to let your product show what it’s capable of.With free trials, customers can quickly see the value in your product before purchasing it. Dropbox, Slack, and Zoom are three companies that used a product-led strategy to advance their business to unimaginable levels. The free version introduces users to the basic features of the software product, leaving users to decide if they want to upgrade to full-featured paid versions.

4. Lead the way

Your SaaS company is the best place to understand your product usage. If your product is not satisfactory within your context, there’s no reason to expect a customer to have a different experience.

Once you have some growth indicators through your product, it’s easier to make your prospects confident about what they’re paying money for. You’ll also be putting the strength and quality of your brand on display.An example of a company that used its product to show how valuable it can be to the customer is Salesforce. If you successfully use your own product, that is all the evidence the customer needs. Salesforce is a leading cloud-based CRM software, but they achieved greatness by being an excellent example of product leadership for other SaaS companies.

Which SaaS Metrics Should You Pay Attention To?

“Focusing on Customer Lifetime Value (CLV) and Customer Acquisition Cost (CAC) without obsessing over churn is like driving with the gas and brake simultaneously—optimizing for sustainable growth, not just damage control.”

Jacek Głodek

It’s necessary to use the proper measurements of your performance in the SaaS business. It prepares the path to develop suitable strategies for high growth through having the appropriate benchmarks in place.

Having suitable KPIs for your context is necessary, but you also need to know what metrics to focus on while you work to ramp up customer patronage over the long term.

These are 10 of the main metrics that matter in SaaS.

1. Customer Churn

Churn is an interesting concept in business that companies use to determine how many customers or how much revenue they’ve lost in a given period – typically monthly.

As much as companies need new customers to grow, they also need to maintain existing ones.

SaaS companies are heavily reliant on subscription services. As a result, customer churn is an essential consideration. Customer churn is the first churn twin (the other is customer churn) and represents the percentage of customers lost during a given period.

Therefore, the customer churn metric measures customers or accounts that quit using the services a business is offering within a specific period. Determining the churn rate enables SaaS companies to understand better how customers interact with their products and how they do so.

The insights from customer churn studies help businesses to develop improved retention services. Each time a customer walks away from a company’s services, the company begins to seek ways to attract and retain a prospective replacement.

The scenario is similar to when an employee leaves a company an organization. Companies must then determine the customer churn rate to determine the overall health of the business.

Customer churn isn’t just about taking a headcount of customers. It’s equally essential to figure out the personas of these churned customers, including the industries or any other factors that can help your company understand why they’re not renewing.

It’s best for this conversation to hold across customer success, marketing, and sales departments. In one peculiar case, Zoom reported a higher churn rate during the pandemic than before it. CFO Kelly Steckelberg put it down to people starting to travel more after a year indoors. Kelly fully expected their churn rate to keep rising until some equilibrium comes into play.

2. Revenue Churn

This type of churn is the second type of churn and refers to the percentage of revenue lost in a given period.

Revenue churn is as crucial as churn rate. It may be more important depending on the context. It includes revenue lost from canceled customers, tier downgrades, and other forms of lost monthly revenue.

A straightforward approach to thinking about revenue churn is to say, from the x customers that canceled in the previous month, how much MRR or monthly recurring revenue has the company lost from them?

The way to calculate churn

A high net revenue churn – more than 2 percent per month – is a big red light. It shows there’s something tellingly wrong with your business because you’re on course to lose 22 percent of revenue every year unless you take drastic measures to stem the tide.

Losing 25 percent of your revenue will have a negative impact on growth even as business gets bigger.

It’s advisable to fix the underlying causes of revenue churn before addressing other issues in the growth equation. Possible reasons why a SaaS company is experiencing revenue churn include:

- Your product not meeting consumer expectations because:

- it doesn’t provide the expected value or utility for the customer

- it’s buggy and still has significant issues

- Your product doesn’t stick well enough. Customers should develop an attachment to your product that makes it form an essential part of their daily routine. That’s the only way they’ll be happy to keep paying a monthly payment.

The trick is to build the product so that it becomes part of their monthly workflow. They can also store high-value data in the product, such that they lose the value if they opt to cancel.

- You haven’t got the customer’s users to adopt the product, or they’re still dragging their feet on using critical sticky features in the product.

- It’s also important to consider if your sales team oversold while the product under-delivered. Sometimes, a customer who should not benefit from a product can pay money for it, but they may choose not to renew or upgrade.

- If the SaaS targets small businesses only, it’s good that there are many of them. The only problem – and it’s a real problem – is that it’s slippery ground because many small businesses go out of business within a few years.

Therefore, while you make your product sticky, the customer has to be sticky too.

- Your pricing doesn’t promote expansion bookings.

It’s usually a great idea to consider revenue churn alongside customer churn. The reason is to find enough latitude to evaluate the external impact some customers might have on others.

Consider the scenario where subscription price varies according to the number of users a customer pays for. The customer churn rate might differ significantly compared with the customer churn rate if some customers generate more revenue than others.

It’s advisable to measure both customer and revenue churn to avoid being blindsided when preparing quarterly or yearly comprehensive reports.

3. Activation Rate

Consolidating the specific steps that users take upon discovering the value of your product is the goal of the activation rate metric.

A suitable example is if a user downloads a VR game app, activation only happens when the user has completed the first in-app purchase. As soon as this happens, the user has begun to experience value in the product.

The company can now use what it knows to fine-tune the user journey, enabling them to optimize the user experience for other users.

Now that it’s clear how users engage with aspects of the product, it also becomes clear what matters to them. The company can then consider ways to help users harness the value across parts of the game.

Activation rate indicates the level of engagement or user interaction. In other words, it’s a direct measure of how successful a product is, so it’s a crucial metric for SaaS businesses. It’s common for users not to re-engage with a software service as soon as they go past gratis levels.

The game company in our illustration will then decide ways to keep customers interested in their product.

4. Burn Rate

Startups usually don’t have an endless stream of cash in their early days. Investors are interested in how quickly these companies use up available cash. This is the essence of the burn rate.

Burn rate is a metric common in the SaaS industry that tracks the rate at which companies use up their cash supply over time.

The SaaS industry cares about two types of Burn Rate metrics:

- The Gross Burn Rate refers to the amount of money a company spends per month.

- The Net Burn Rate refers to how much money the company loses per month, that is, Gross Burn Rate – Revenue. Where earned revenue is greater than the amount spent in a month, there’ll be a negative Net Burn.

Investors are particular about Burn Rate because it gives a solid idea of when the company will consider raising the next startup funding round. Consider a Net Burn Rate of $200,000 and $4 million in the bank.

The company has exactly 20 months of cash left – known as the company’s cash runway. If that burn rate had to rise to say $400,000 for whatever reason, the runway would immediately drop to 10 months.

Redpoint Ventures’ Tomasz Tunguz goes further to clarify Base Burn Rate and Growth Burn Rate.

Base Burn covers the company’s spend on benefits, salaries, legal fees, real estate, and all other operating costs. On the other hand, Growth Burn Rate includes the marketing and sales costs of new customer acquisition.

SaaS companies need to manage their businesses such that they become profitable on Base Burn. Even when they’re low on cash, the company could step back on new customer acquisition to generate profit.

5. Customer Lifetime Value (CLV)

The Customer Lifetime Value (CLV) is the average amount of money your customers pay while doing business with your company. It enables businesses to have an accurate picture of their growth.

Here are the steps in calculating the customer lifetime value.

- Calculate the customer lifetime rate by finding the reciprocal of your customer churn rate. That is, you divide your churn rate by the number 1. If your monthly churn rate is 1 percent, then your customer lifetime rate works out to be 1/1% or 1/0.01 = 100.

- Calculate the average revenue per account (ARPA) by dividing total revenue by the total number of users. Let’s say your revenue was $100,000, divide it by 50 (your customer total) bringing your ARPA to $2,000 ($100,000/50 = $2,000).

- Then we calculate the customer lifetime value by multiplying the customer lifetime rate by ARPA. That is, CLV = CLR x ARPA. In our example, this brings the lifetime value to $200,000 ($2,000 x 100 = $200,000).

Knowing your CLV numbers helps your company to determine the worth of the average customer. Startups can use it while pitching to investors.

Because most SaaS businesses operate using a subscription model, each renewal provides recurring revenue, effectively raising the lifetime value of each customer.

6. Customers Acquisition Cost (CAC)

So, how much do you spend to acquire a new customer? The Customer Acquisition Cost is the metric SaaS operations can use for this purpose. It gives an indication of what it costs to acquire new customers and the value they bring to the business.

When combined with the CLV, the metric allows companies to demonstrate the viability of their business model.

The majority of B2B SaaS businesses have two factors that determine how much they spend to acquire new customers:

- The costs of generating a lead (essentially marketing expenses)

- The costs of converting the lead into a customer (essentially sales costs or touch costs, which include the salaries of sales development reps or field sales employees)

The way to arrive at the customer acquisition value is to divide total sales and marketing spend (personnel is part of this) by the total number of new customers you add at a specific time. For example, adding 100 customers after spending $100,000 means your CAC is $100,000 / 100 = $1,000.

In order to apply this formula regardless of the SaaS provider, you bundle total sales and marketing spend in a specific time period (periodt). Then you divide it by the total number of new customers.

Therefore,

CAC = (Sales & Marketing Costt) / New Customerst

So, spending $10,000 on sales and marketing efforts in a given month and closing 10 new customers in that same time, leaves the Customer Acquisition Cost as follows:

CAC = ($5,000 + $5,000) / 10

= $10,000 / 10

= $1,000

It’s common for CAC calculations not to account for costs and revenue linked with customer success strategies.

Customer success teams generate significant revenue by encouraging renewals, cross-selling, and upselling. Yet, CAC can measure your SaaS’s capacity to generate new revenue from sales and marketing expenditures.

Including customer success in calculating the customer acquisition cost distorts the measurement, however. That’s why it’s advisable to track it separately.

Separate acquisition cost calculations also matter when working with lead generation from paid and unpaid channels. When you generate 100 non-paying customers using a total CAC and 20 paying customers at $500 CAC, the average CAC is around $83.

This “blended” CAC is accurate but not worth much in terms of providing insights into sales and marketing strategies.

New companies need to prioritize customer acquisition to have a good chance of surviving. Companies can manage growth and accurately determine the value of their acquisition process when they have their customer acquisition rates down to hard numbers.

Dave Kellogg’s Alternative CAC

An abstract dollar value may seem concrete, but a more comprehensive approach to calculating CAC is to compare sales and marketing expenditure in the previous period (S&Mt-1) to the present revenue in the current period (New ARRt).

It is effective in revealing how much the SaaS company is generating one dollar of new customer revenue:

CAC = (Sales & Marketing Costt-1) / New ARRt

Let’s imagine that a company spent a combined total of $10,000 on sales and marketing the previous month and generated $12,000 in new revenue in the current month. The interpretation is that for every dollar of new revenue, it cost $0.83 to generate it.

CAC = ($5,000 + $5,000) / $12,000

= $10,000 / $12,000

= $0.83

Dave Kellogg of Host Analytics points out that a CAC of 2.0, that is, it pays $2 for every ARR dollar. SaaS companies usually sell monthly subscriptions, so if customers stop paying by the ninth month, a CAC of 2.0 calls for urgent action.

According to Dave, there is no right or wrong answer to what a company wóuld be willing to pay to acquire a customer. Whatever a company pays for a customer is proportional to what the customer is worth.

8. Monthly Recurring Revenue (MRR)

Since SaaS businesses thrive on a subscription model and customers make recurring payments, it’s easy to track and forecast revenue. Other companies have a significant challenge in trying to do this. That’s where the Monthly Recurring Revenue or MRR is essential. It’s one of the ways to analyze recurring revenue.

The Monthly Recurring Revenue is essential to appreciate the growth of a business. It’s a nifty tool for predicting future revenue as long as you have a good idea of the acquisition rate and customer churn rate.

The technique for finding the MRR is straightforward: for every given month, sum up the recurring revenue generated by customers in that month.

MRR = (Average Revenue per Account) x (Total Accounts in a specific month)

That means that if in October, there were 100 customers, and each one paid $2,000, the MRR rises in November if there’s one new customer acquired.

- New MRR

This is revenue from new customers per month.

Suppose you have five new customers who bring in total revenue of $1,000 per month and two other customers who bring in a revenue of $2,000 per month.

Your new MRR is [($1,000 x 5) + ($2,000 x 2)] = $9,000

- Expansion MRR

This is revenue earned when a customer upgrades opts for a higher-tier plan.

So, if two customers on your $1,000 monthly subscription upgrade to the $2,000 plan, your expansion MRR is $2,000.

- Churn MRR

This is the opposite of expansion MRR. It’s the best way to know what you can’t earn when a customer downgrades to a lesser plan or cancels.

If a customer opts out of your $2,000 monthly plan in preference for your $1,000, your churn would be the $1,000 difference.

9. Annual Recurring Revenue (ARR)

The Annual Recurring Revenue is one of the major SaaS metrics. It represents the Recurring Revenue of each subscriber within a twelve-month cycle.

SaaS and subscription companies offering a defined contract length use ARR as an indicator when term agreements have a minimum duration of 12 months. There are several ways to calculate ARR across different contracts.

If Customer A signs up for a 1-year subscription tier at $14 per month, that amounts to $168 per year.

If Customer B signs up for a 2-year subscription tier at $12 per month instead, it amounts to a value of $288 or $144 per year.

What’s important in these calculations is that they cover the essential ARR, especially its critical categories – New, Lost, Expansion, and Contraction. It also covers the trends and velocities in those numbers.

ARR is an important measure of business health since it highlights what one can expect to repeat and what to improve.

10. Net Promoter Score (NPS)

Companies need a reliable predictor of future churn, and customer satisfaction is a good variable for this purpose. A customer survey satisfaction is an excellent technique to use, and the Net Promoter Score is the perfect metric for it.

The Net Promoter Score is a standardized number, which means you can compare your company’s NPS performance to those of others.

Companies can, therefore, determine the loyalty of their customer base relative to other companies. It’s an excellent way to feel the consumer pulse towards a company’s product.

Typical NPS-focused surveys deal with consumers’ willingness to reuse a product or recommend it to someone else.

Teething SaaS businesses will benefit from the insights this metric provides. They’ll be able to quickly make adjustments to their product to keep their customer acquisition gains on an upward trajectory.

Best Practices for SaaS Growth

Now, how can anyone really grow their SaaS imprint? Mind you, “anyone” includes “you.” Well, first, the great advantage of the SaaS model is that it’s trackable and measurable.

Having a good handle on your statistics enables you to spot weaknesses quickly and address them. You’ll also learn if you’re really as strong in one area as you think you are.

So, the key to SaaS growth is continuous measurement. If you fail to measure, you’re preparing to lose the game resoundingly. The best part is that all you need are KPIs, not an advanced degree in analytics.

Oh! The tools you need are already available with another SaaS company, so you can get help when you need it. Once you do, you can follow these tested best practices to boost the growth of your SaaS.

- Offer free trials or use the freemium model

We’ve already discussed how letting users try out your product for free can help you gain some vital traction.

Here’s the logic with this: people get to know your product and can tell others about it. It’s easier to get people to pay for or recommend food they’ve tried. The trick to making this work is to make your product convincing enough to make them become long-term users and advocates.

Er, there’s no point in giving away too much for free. Have a churn rate you can live with; otherwise, you’ll not have many people paying for your product if everything they need is available gratis.

Your first assignment is to discover what your users consider to be free features.

- Lock in on customer quality

How many customers do you have?

Another one: how many customers do you keep?

Customer retention is the first base of growth. If 100 customers leave your service, they are not worth as much as, say, 15 who continue to use your service. Those fifteen are quality customers.

You’ll find many SaaS companies using discounts. Great idea it is, but discounts eventually go away. There’s little chance that those guys will stick around after that. So, be wise with how you offer discounts.

- Now, go viral

You’ve tried plenty of things in life, and it’s not because you liked them!

Everyone seemed to talk about them until you got hooked. If people say a product is special, you feel special when you use it. That’s the power of influencer marketing. Some people with clout use a product, and the rest of us just follow suit.

There are no limits to creativity when you want your product to go viral. Just throw in something unusual that gets people talking, and you’re on the way up.

- Launch like you know your onions

Your launch should never be without a BIG buzz. How you launch your SaaS product determines the impact you can have.

Many products now use the invite-only launch system that Gmail deployed years ago. Gmail creators created an aura of uniqueness around the product, and as you can confirm, everyone wanted a username as soon as public access became available.

If you plot things right, you’ll have enough momentum at launch to keep you in business.

- It’s all about teamwork

Your people are the real engine of your business. You must make sure they enjoy they have the right mix of skills and the right attitude to deliver their A-game every day.

Nearly 80 percent of employees walk away because they are under-appreciated. Come on, do what it takes to build a fantastic work environment that makes people forget where the exit is.

Conclusion

What’s the takeaway from all this? In an era of smart consumerism (had to throw that in), survival depends on embracing business intelligence.

You need to understand the tools, platforms, and metrics that will help drive your SaaS business to the top of the pack. The ten metrics in this guide are more than enough to position your company as the top dog in your industry.