Some of the most innovative industries in the world are tilting their focus towards blockchain, and the real estate market is no exception. Today’s conventional way of owning, selling, and buying property is quite complex. However, one thing that attracts people to blockchain real estate is its ability to provide transparency, ensure security, and make transactions more efficient. Given its current applications, blockchain’s disruptive potential isn’t a distant dream.

So, how exactly does blockchain achieve all this, and why does the real estate sector view blockchain adoption with such enthusiasm? Let’s get familiar with the technology and see how it’s being applied in the industry. You’ll also learn that while blockchain is generating growing excitement, it faces several challenges as well.

What is Blockchain

Blockchain uses distributed ledger technology to secure and timestamp transactions on multiple computers, in a digital, open ledger. It provides a way of recording transactions across multiple computers so that everyone’s ledgers are identical and secured, yet transparently visible by anyone on the network or who has an interest in seeing them.

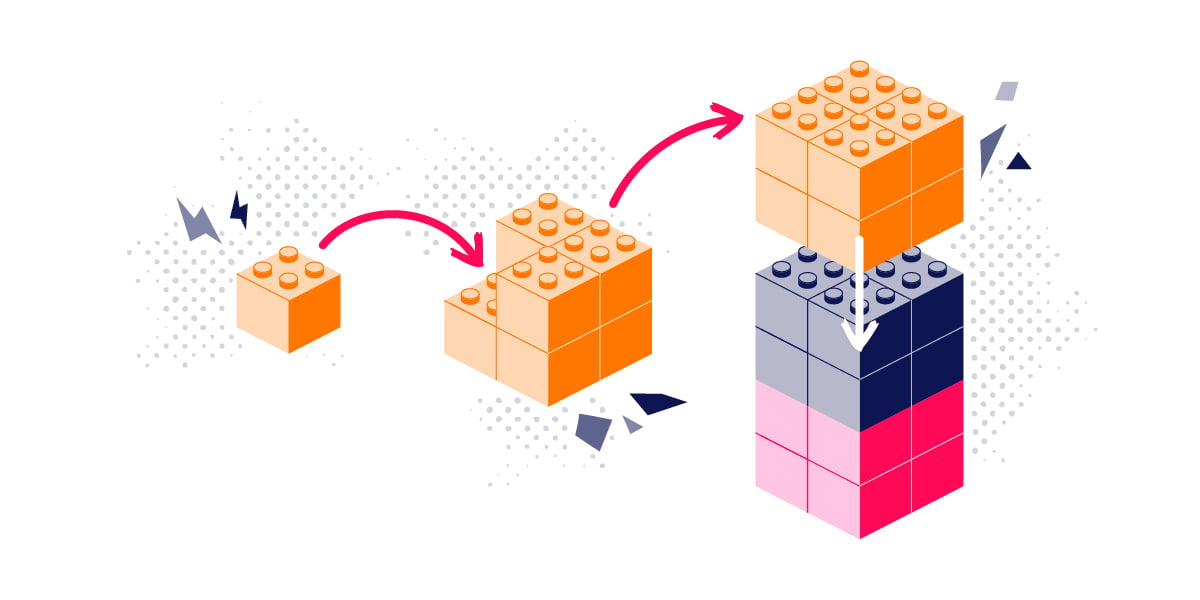

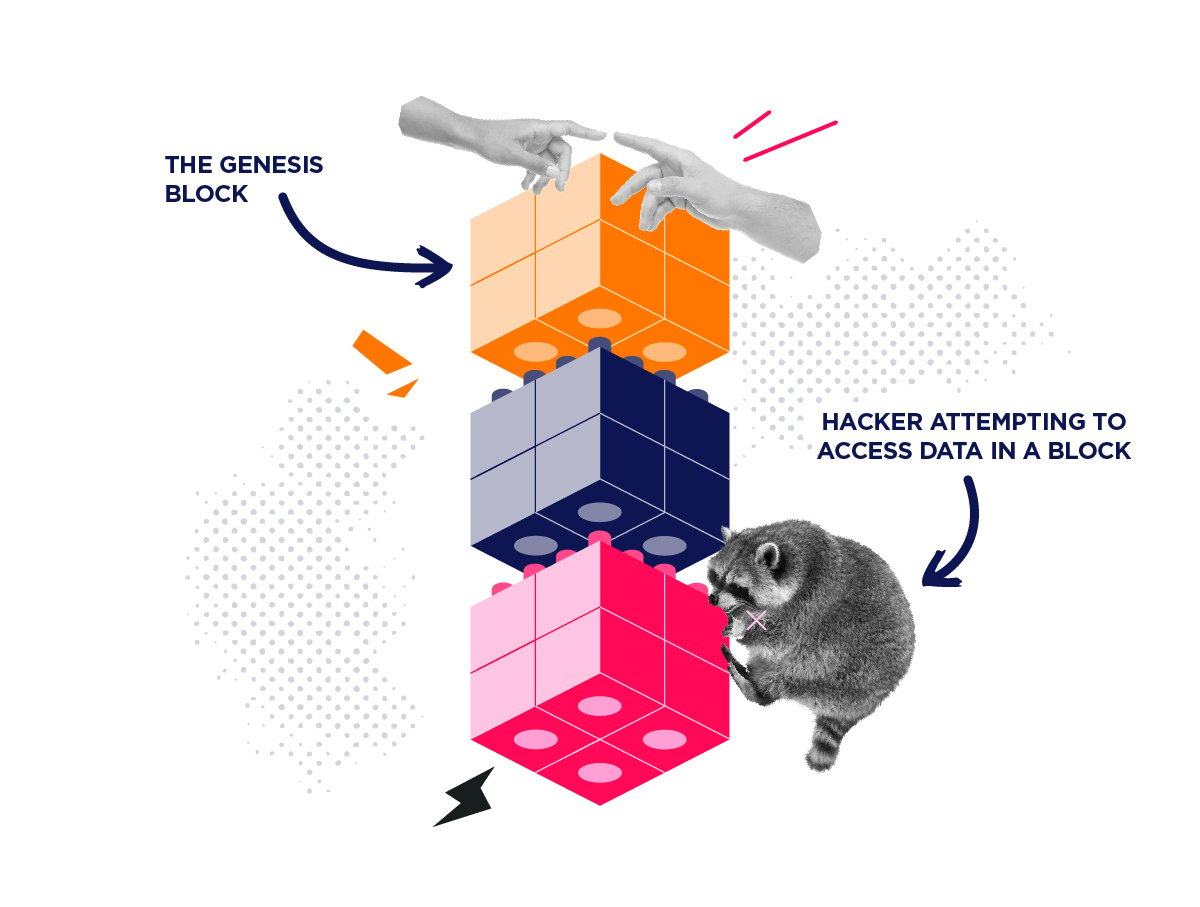

The transaction is recorded on a line, like Legos, to form a block. When sufficient participants validate the transaction, it is attached to the previous blocks that form a chain. Because it’s spread across every computer on the network, it is literally impossible to falsify it. Also, the fact that no one controls the data makes it tamperproof.

In real estate transactions, blockchain could replace centralized data resources like land records with distributed, decentralized ones. This will help to guarantee transactional trust by letting all parties to an exchange see the same information, all kept in an unchangeable database.

Benefits of Blockchain Real Estate

Blockchain technology is set to make waves in the real estate sector. Here are the major advantages that blockchain brings to the sector:

1. Transparency

One major advantage of real estate blockchain technology is its ability to provide a high level of transparency. The rise of blockchain games shows how blockchain is being used to create transparent, decentralized platforms. In traditional property markets, it is often necessary to consult a number of parties to confirm the rightful ownership of a property, to track its historical sale transactions, or to obtain information on the property’s financial records. Each of these steps often requires multiple verifications or intermediaries, thus creating the risk that an intermediary or one of several verifiers might even make a mistake or be tempted to fake the record to their advantage.

Blockchain handles this process by creating a record, which is replicated independently on every computer on the blockchain network. Every information pertaining to a transaction is made available to every party in that transaction, creating a single, shared, immutable truth. For example, land registries and records of all previous sales can be logged on the blockchain along with the entire history of a property. Besides expediting this process, transactions have greater legal certainty because the data is immutable. This means that once a transaction is verified, it cannot be modified.

2. Access to Global and Public Assets

Real estate has traditionally been a local business. Even when investments are made across regions, they are largely limited to that geographic area. Blockchain real estate is now breaking these limitations through tokenization. Tokenization technology converts the ownership of a property or a share of a property into a token on a blockchain and this token can then be bought and sold on a peer-to-peer exchange. So a token could represent a certain percentage share of a property and can be seamlessly exchanged on a peer-to-peer network.

The advantage to investors is that they no longer have to be part of the world’s richest real estate markets in order to realize capital gains in the property sphere; they can earn that capital by investing in less developed regions. For example, a European investor with only a few thousand dollars could own a fraction of a business park in New York, whereas before, these opportunities would have been restricted to large institutional investors. Blockchain also enables the trading of public assets such as land or government buildings, which is otherwise difficult to execute nationally, or even among a relatively small group in a local market.

3. Enhanced Security

Security is particularly important in the real estate business where huge amounts of money change hands and a wealth of personal information is stored. Real estate transactions are still often run through centralized databases that are more susceptible to hacking, fraud, or data breaches. The decentralized nature of blockchain technology greatly reduces such risks. Every block is tied to a previous block using an unbreakable cryptographic hash, and the data in each block is encrypted.

Furthermore, smart contracts (automated contracts embedded into the blockchain) can enforce security protocols, such that any physical exchange is allowed to continue only after certain conditions have been met (eg, payments, legal checks, ownership transfers). Owners, buyers, and brokers can have faith that transactions will not be manipulated. This kind of automation introduces predictability, accuracy, and reliability to a notoriously process-heavy business.

4. Streamlining Transactions

Home buyers often have to wait weeks, and possibly months, before completing the transaction. This is partly because the process requires the involvement of several intermediaries. Blockchain’s digital ledger handles property transactions by unclogging the pipeline and eliminating the choking third-party verifications and extensive legal procedures.

Smart contracts may be programmed to automatically execute the payment of funds and the transfer of property titles once certain conditions are fulfilled. This will diminish the need for third-party intermediaries, hastening the process, and reducing the likelihood of disagreement. If applied correctly, blockchain technology could reduce a deal’s closing time from weeks to merely a few days.

5. Reduced Costs

The commission paid to a real estate agent and the legal fees for documents and deed filing can add around 6 percent to the cost of a home. Other administrative and related expenses can bring the total out-of-pocket expense to around 10 percent. With blockchain, those costs could be cut by a fraction, or even eliminated entirely. Most intermediary roles would fall away. The banks, title companies, and escrow services will become less important once you can prove, on a distributed, secure ledger, that everyone has gotten paid.

Additionally, blockchain technology can also lower the administrative costs involved with property management, since record-keeping, transferring property title, and property ownership protection all become automated tasks. For people buying and selling property, that translates to less money spent, and more time spent doing what they do best.

Blockchain Real Estate Applications

Here are the most prevalent blockchain applications in real estate:

1. Data Management

Data is the heart of real estate, so any mistakes can have significant repercussions. Usually, thousands of data points such as historical ownership records, transaction details, and financing information are saved in multiple private databases by various parties, all with potential inconsistencies and discrepancies. Blockchain offers a shared ledger that could house all property-related data, and eliminate these inconsistencies.

All transaction and ownership data and information for any property or land are securely stored within a block and cannot be altered. It is immutable and time-stamped, making all updates clearly visible to all vested parties. Blockchain’s ability to securely store and manage data is not limited to real estate—it is also changing industries like logistics. Learn more about the different ways blockchain technology can disrupt supply chains.

2. Property Management

Blockchain can help to bring efficiency to managing your property. It can simplify the management of units, distribution of lease agreements, and maintenance history or interaction with your tenants. Smart contracts could be used to automate lease agreements so that incoming payments are triggered on certain dates. Likewise, maintenance requests can be traced in real-time through a centralized system that gives landlords transparency to prevent rent increase disputes in contract renewals.

Decentralized platforms allow tenants and property owners to communicate directly with one another, without dealing with intermediaries from property management firms. Rent payments could be processed on a blockchain-based platform, as could other services such as maintenance payments. ManageGo is already helping property managers process payments with ledger-backed software. The app includes a rent processor that instantly converts digital currencies into fiat before sending them to landlords.

3. Property Tokenization

Property tokenization is one of the most prominent blockchain applications in real estate. It involves converting real estate into digital tokens that can be traded on blockchain platforms. A property can be divided into thousands of tokens and trusted network participants can buy fractional shares of it. RealT is already making strides in this field. The blockchain real estate technology firm allows investors globally to own a share of real estate, with as little as $50.

This model facilitates the international flow of capital as tokens can be bought and sold across borders, and the liquidity of real estate markets will increase. Investors can now diversify their portfolios by purchasing an equity interest in a number of properties, rather than owning them outright. Likewise, developers and property owners can finance their operations through the sale of tokens tied to their real estate assets.

4. Mortgage and Loans

Mortgages can take time to approve. They also cost a lot and involve a lot of paperwork just to verify someone’s credit history, income, and property value. Blockchain as a public provides a means for all this information to be stored and verified across a network of thousands of devices. This allows a lender to assess whether a prospective borrower is creditworthy in a matter of seconds instead of days or weeks.

Moreover, loan repayments in mortgage contracts can be automated on a blockchain, with regular payments automatically withdrawn from the account of the borrower and paid into that of the lender, without intermediation and the risk of late payments.

5. Investor and Tenant Identity

The identity of investors, tenants, property buyers, and other parties needs to be verified in all real estate transactions. Blockchain provides a quick and secure way to do this. It can store and secure identity data, enabling participants in a real estate deal to quickly and confidently verify another party. For example, a landlord verifying a tenant, or a property buyer identifying a landlord. The verification process is usually done through Know Your Customer (KYC) and Anti-Money Laundering (AML) checks. And the best part is that they can be automated to save time and effort.

This approach to investor and tenant identity can be particularly useful with cross-border real estate purchases. Here establishing the identity of international investors can be cumbersome and time-consuming. However, storing and sharing identity information over a network and securing it with blockchain makes it much easier to establish who is who.

Challenges of Blockchain Real Estate

Although blockchain has remarkable potential in real estate, it presents a threat just as much as an opportunity, especially for traditional players:

1. Regulatory Hurdles

Land transactions usually require a legal stamp approved by traditional intermediaries: notaries, land registries, and general governmental bodies. With blockchain, smart contracts and digital ledgers might be used to short-circuit these entities, creating a situation where nobody is in charge. The question then is: what is the legal status of a blockchain-registered deed of sale?

For example, if you buy a house in the US which has no single blockchain real estate law, multiple layers of local, state, and federal law could come into play in such a transaction, creating regulatory confusion. The legal implications around smart contracts and blockchain-led transactions remain inconsistent in many parts of the world.

Governments will need to create new legislation or update existing laws to ensure that citizens and businesses are permitted to enter into blockchain-based contracts and that dealings involving such transactions are legally recognized. Until the laws are clear, many real estate companies will be hesitant to embrace blockchain due to its legal validity and compliance concerns.

2. Security Concerns

Blockchain is generally considered more secure than a typical real-estate process. This is because it incorporates cryptographic encryption, decentralized data storage, and other mechanisms that help ward off fraudsters and human error. Yet, it’s not totally bulletproof. Smart contracts could be subverted by hackers if the code isn’t written properly. Code could also inadvertently cause mistakes if the person or computer that wrote it made an error or entered invalid data. Unfortunately, blockchain enforces the immutability of the data, making this type of mistake irreversible.

Even though Honduras implemented a blockchain-based land registry, some government officials were able to alter the country’s land ownership database to steal property for themselves. Perhaps the most notorious recent example is the fish loan cyberattack on March 13, 2023, when hackers stole $197 million in wrapped Bitcoin (wBTC), DAI, and USDC from Euler Finance.

Of course, the fish loan hack was not directly connected with property, but just like the case of an altered land registry in Honduras, it shows the potential consequences of blockchain vulnerabilities. To boost confidence in blockchain, the industry will have to adopt better security-related practices such as security audits and better coding standards.

3. High Costs

It is easy to think that by eliminating intermediaries, blockchain can reduce transaction costs. However, the setup costs —including the cost of the infrastructure to support blockchain and the human capital investment in training staff to use it—could be very high. This is especially true for small and medium-sized real-estate firms that may not want or be able to bear the expense of a new piece of technology.

Besides the initial launch costs, real estate companies should consider the costs for ongoing upgrades and cybersecurity defenses for blockchain systems. While anticipating these costs, you must be mindful that they are just speculation, as the technology is still in its infancy. The expenses could turn out to be far more than anticipated. After all, cybercrime is an ever-evolving threat.

In the long term, operational costs will decline but the upfront cost of blockchain implementation is a critical hurdle, especially for firms operating in markets with thin margins.

4. Resistance from Traditional Players

Blockchain is a threat to many of the middlemen in the real estate industry —the brokers, the agents, the title companies, the notaries, and so on. The traditional business models have served these parties well for decades, even centuries. If this technology could make more of their jobs obsolete, they would not appreciate it.

Imagine that you no longer need an escrow company to take payment and release funds at the end of a property sale. Why? This transaction can be done quickly with smart contracts. Title companies could also be eliminated due to blockchain-based records of property titles that can be permanently verified. These challenges have led to public speculation that many key players will resist the wider adoption of blockchain because it threatens their business prospects, be it loss of employment or loss of fees.

This resistance to change may affect the legal industry too. Lawyers may resist blockchain-powered smart contracts amidst concerns over enforceability and the loss of billable hours spent in managing contracts manually. If blockchain meets similar resistance from brokers, agents, and other intermediaries, it is likely to slow blockchain’s full acceptance in that industry.

5. Shortage of Blockchain Expertise

There’s a shortage of relevant talent, consisting of people who understand how to design, manage and secure blockchain systems. Most real estate companies cannot procure these skills alone in time to compete in the fast-approaching era of blockchain real estate.

A real-estate startup, for example, that wants to tokenize assets or use blockchain to facilitate property transfers would have to rely on blockchain developers to build that infrastructure. However, blockchain developers are few and are in high demand by companies in the finance and health sectors. So, real estate firms often find it hard to attract the best developers.

Moreover, many existing real estate agents and brokers are not experienced with blockchain, and this knowledge gap needs to be filled with training and education. Real estate firms could end up using poorly designed systems, which could have security and other liabilities if not properly implemented. They will need to build internal expertise or partner with blockchain specialists to develop blockchain training programs for their development team.

Selecting a Solution for Blockchain Real Estate

Below are key factors to consider when selecting a blockchain solution for real estate operations:

1. Scalability

One of the most important considerations for any blockchain solution is the level of scalability. Since real estate transactions represent a large volume of data a blockchain system needs to be able to cope with an exponential workload as the number of transactions increases.

Moreover, some blockchain networks, especially the early ones such as Bitcoin Cash and Ethereum – have not demonstrated the capability to execute large number of transactions per second. Ethereum, for instance, averages a maximum of 15 transactions per second, which may be insufficient for large-scale property registrars. Private or permissioned blockchains such as Hyperledger or Corda may be a better option for real estate companies.

2. Security

Since properties are high-value transactions, security is another important consideration. When choosing a blockchain solution, you must ensure that the platform has the best security mechanisms to prevent data breaches, fraud, and hacking. Blockchain’s inherent security features, like encryption and decentralized storage, can keep sensitive information like the ownership details of a property and the finances involved safe.

However, blockchain solutions are not all created equal. For example, a public blockchain is presumably more subject to what is called a 51 percent attack. It’s a situation where miners are able to seize control of a network and re-write transactions by controlling more than half the computing power of the network. A private blockchain would avoid such situations by restricting access to trusted participants.

Real estate companies should work with blockchain developers to perform security audits and implement best practices to make sure that the platform is less susceptible to attacks.

3. Cost Efficiency

The cost factor is another important aspect to consider, especially for smaller real estate companies working on tight budgets. Blockchain can cut out the middlemen and reduce backend costs in the long run, but the initial setup and maintenance of a blockchain system can be costly. The exact cost depends on what type of blockchain network you decide to use, the number of nodes, and the extent of customization you need.

For example, a public blockchain such as Ethereum may have high transaction costs (called gas fees) that fluctuate as the network gets busy. A private blockchain, on the other hand, might be less expensive to operate but will require an investment in infrastructure that needs ongoing management. Companies will need to assess how these costs stack up against the benefits of automating processes and replacing intermediaries.

4. Interoperability

To be useful for real estate, a blockchain platform will need to interact with numerous external systems, such as government land registries, banks, legal jurisdictions, and enterprise property management software. Without interoperability, it will be difficult to fit new blockchain technology into existing real estate workflows.

A blockchain real estate for a property transaction might need to interact with legal databases for proof of ownership, or mortgage systems to run a loan. Without interoperability, it would be impossible to make these connections.

So real estate companies should focus on choosing the blockchain platforms that will sync well with existing systems and with other blockchain networks. Projects such as Polkadot and Cosmos are promising enhancements in cross-chain communication. These networks are becoming increasingly important because, as real estate processes are digitized, they are, inevitably, going to span across different blockchains and ecosystems.

5. Regulatory Compliance

Real estate transactions are already highly regulated, and the exact nature of these regulations varies from jurisdiction to jurisdiction. Blockchain-based solutions will, therefore, need to align with local, national, and international law pertaining to property, contracting, taxation, and anti-money laundering (AML). Real estate firms should use blockchain platforms that assist them in complying with these regulations, especially when conducting cross-border transactions.

A real estate startup must create KYC and AML protocols. The blockchain solution Corda has been designed with a focus on regulatory compliance. Companies might consider working with legal counsel to ensure their smart contracts qualify as binding instruments under local laws.

Blockchain service providers must also adapt, and choose solutions that can be updated to fit new compliance requirements. They must establish partnerships with governmental bodies to integrate land and property registers.

The Future of Blockchain Real Estate

Here are some emerging trends and future possibilities for blockchain in real estate:

1. Decentralized Property Markets

Perhaps the most interesting application for the future would be the emergence of new peer-to-peer property markets. If a property is registered on the blockchain, the land registry becomes obsolete. Buyers and sellers could then connect directly via a blockchain app, eliminating the need for an estate agent or broker. The whole process, from checking entitlement to transferring the money, could be automated by using a smart contract.

Such platforms would encourage transparency, and cut transaction fees. Propy, a blockchain real estate platform that enables cross-border property sales without intermediaries, is an encouraging first step. Soon, many more platforms like Propy will invite homeowners from all over the world to list their properties on a global marketplace, without dealing with traditional gatekeepers.

2. The Integration of AI with Blockchain

AI and blockchain might work together to make processes even faster. Using machine learning, for instance, AI applications can process property data sets and learn to make predictions from them. They’ll be able to quickly and reliably predict market trends to better tailor the advice they give to real estate professionals looking to buy, sell, rent, or build.

With the help of integrated agents, AI could automate property appraisals, rental portfolio management, and even property investment by optimizing a portfolio’s overall value based on accumulated data. The transparency and immutability of blockchain could give AI a more reliable, tamper-proof data set, allowing it to predict the real world more accurately. Here is everything you need to know about AI in blockchain and how it works across different sectors.

Ready to Adopt Blockchain? Let’s Help Ensure Your Success

Ultimately, blockchain’s benefits for the real estate industry are a win-win-win proposition, with increased transparency for all parties involved, stronger security measures, improved efficiency, and significant cost savings. Nevertheless, you’ll face several hurdles when trying to integrate blockchain into your real estate company. These include regulatory constraints, security concerns, and the need for a scaled technology. That’s why teaming up with a trusted tech expert could come in handy.

We are here to help you declutter on your way to blockchain adoption. At IteratorsHQ, we assure you that your blockchain applications are tested rigorously to standard and covered with a quality-first approach. Our risk mitigation helps ensure that your blockchain real estate solutions work efficiently. Contact us today, to understand how we can help you adopt blockchain technology in real estate.