Stripe is one of the top payment processors among online merchants because of its flexibility and security. Studies found that Stripe holds a market share of about 17.33 percent, making it the world’s second-most-used payment solution (after PayPal). As many companies migrate to subscription revenue models, it’s critical to choose the right payment and subscription system. Stripe’s versatility comes into play here as it offers multiple pricing models to fit changing business requirements.

Subscription models with Stripe allow businesses to implement recurring billing, offering options like tiered pricing, usage-based charges, or fixed plans. These models can help businesses ensure predictable revenue streams and foster customer retention.

What is Stripe payment? What feature makes it beneficial to companies? These questions will be answered in this guide. You’ll learn how these payment methods can help streamline your business and create new revenue opportunities.

What is Stripe

Stripe is a payment processing software and API company that lets businesses of various sizes accept and process payments online. Launched in 2010, Stripe has quickly become the top payment service for startups and established businesses. This is due to its easy-to-use interface, developer integration, and powerful tools that process international payments.

So, what is Stripe’s payment method? Basically, Stripe lets you accept online payments with more than 135 currencies and payment methods such as credit cards, bank transfers, and mobile wallets. This flexibility allows companies to customize their payment workflows, from simple checkout forms to advanced subscription billing.

Stripe’s payment features are directly tied to subscription models through its Billing API, which supports automated invoicing, proration for subscription changes, and dunning management for failed payments. This seamless integration of payment methods with subscription workflows reduces friction, enhances customer satisfaction, and simplifies revenue tracking.

The platform also supports popular programming languages and frameworks such as JavaScript, Python, Scala and Ruby. This gives technical teams the flexibility to add payments directly into web or mobile apps. Moreover, Stripe’s advanced security features like tokenization and encryption secure customer data while being PCI compliant. If you are looking to take advantage of a trusted, developer-focused payment platform, Stripe’s architecture and API-first model provide a base for scaling, custom payments.

Need help implementing Stripe? The Iterators team can help design, build, and maintain custom software solutions for both startups and enterprise businesses.

Schedule a free consultation with Iterators today. We’d be happy to help you find the right software solution to help your company.

Features of the Stripe Payments System

Stripe payments are scalable enough to handle any form of transaction, currency, and business structure. Let’s have a closer look at its core functionality and how it fits into Stripe’s overall architecture:

1. Comprehensive Payment Processing

Stripe accommodates both one-time payments and complex subscription models. For subscription-based businesses, the Payments API enables seamless integration of recurring charges, such as flat-rate pricing or usage-based billing. . Stripe’s Payment Intents API allows merchants to create custom flows that control every stage of the transaction lifecycle, from card declines to customer authentication and currency conversion.

2. Subscription Fees

Subscription management is one of the most popular Stripe features. It provides flexibility for recurring revenue-based businesses. Stripe Billing, a dedicated API allows businesses to define and control subscription plans, recurring billing cycles, and pricing. Businesses can set up these subscriptions at flat rates, per-seat, usage, or tiered pricing. The platform also automates bill reminders, renewals, and cancellations, which helps to make subscription management easier for companies.

3. Custom Checkout

Stripe Checkout enables subscription businesses to deliver tailored user experiences. For example, brands can customize checkout flows to display subscription tiers, promotional add-ons, or upsells directly at checkout.. Strategic process mapping can help identify areas for optimization. Stripe Checkout is extremely customizable with single-click payment, language support, and tax calculations. It’s responsive, which means it works on every device, so brands can create a consistent checkout experience across platforms.

4. Global Payment Processing

Stripe’s global infrastructure can handle more than 135 currencies and payment channels, which is perfect for international businesses. The platform automatically handles currency exchanges so that companies don’t have to manually calculate exchange rates, thus they can keep transaction costs clear. Stripe also follows local payment guidelines, such as SEPA Direct Debit in Europe and FPX in Malaysia. This allows organizations to scale globally while staying compliant.

5. Advanced Fraud Detection

Subscription models often involve recurring transactions that are vulnerable to fraud. Fortunately, Stripe has a built-in machine-learning algorithm called Stripe Radar, which attempts to prevent fraudulent activity. Stripe Radar collects millions of data points from across the Stripe network to detect and block fraudulent activity. Businesses can implement custom rules to flag or block suspicious subscription renewals, ensuring the safety of recurring revenue streams.

6. Reporting and Analytics

The Stripe Dashboard gives you robust reporting, providing live access to payments, customers, and financial trends. Key metrics such as gross revenue, average transaction value, and subscription churn, are displayed so you can monitor them easily. By unlocking the power of dashboarding, organizations can customize reports, date range filters, and export data for further review. Also included in Stripe’s reporting is revenue by product line, payment method, and customer data. These metrics give companies a full view of their bottom line.

7. Payment Security

Stripe is PCI-compliant and it has cutting-edge security measures to safeguard businesses and customers. Through tokenization, users can translate sensitive card data into non-sensitive data that Stripe controls internally, so it minimizes the risk of being stolen. Stripe’s encryption and authentication options, such as 3D Secure, add another layer of security to transactions. Moreover, Stripe is compatible with GDPR and other data privacy laws which are important when dealing with foreign payments.

Stripe Subscription Models

Stripe’s subscription models are customizable to match different business types and needs, so it’s easy for businesses to set up recurring billing for products or services. These models support different pricing strategies and businesses can control subscriptions via custom billing cycles, automated invoicing, and more.

Stripe offers several subscription plans, so organizations can choose one that best fits their business, products, and customer base. Here’s an overview of the main models available in Stripe pricing:

- Flat-rate pricing: Simple pricing model where rates are uniform for different service levels.

- Per-Seat pricing: Charges based on the number of users or seats.

- Usage-based pricing: Customers are billed by their usage or consumption.

- Subscription with add-ons: Supports multiple products or add-ons per subscription.

Stripe’s open-ended configuration and setup capabilities allow you to combine these models as needed. This gives companies better control of their billing practices and customer engagement. Now let’s discuss each subscription model in detail.

Flat-rate Pricing

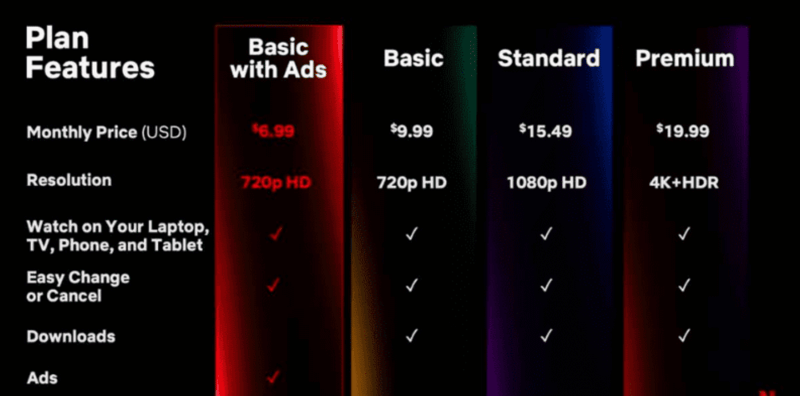

Flat-rate is a simple subscription in Stripe where people pay a fixed amount for a service or product on a periodic basis (like monthly or annual). This model is common among businesses with clearly defined service tiers with pre-bundled functions. Stripe allows for flat rate pricing for companies that want straightforward billing and open pricing for their customers.

Netflix is a good example of a flat-rate subscription. Subscribers pay a monthly subscription fee to view unlimited movies, TV series, and exclusives. Netflix charges a consistent rate for your plan regardless of how many movies or TV shows you watch. All the content is included with a flat rate, there are no separate per-show or movie costs, just differences in the number of simultaneous streams and quality of the video.

Use Cases of Flat-rate Pricing

- SaaS Platforms: Standard service levels (Basic, Pro, Enterprise) and feature tiers.

- Streaming Services: Monthly plan with unlimited content library.

- Membership-Based Services: Monthly fees that are fixed for clubs, groups, or associations that provide content, events, or benefits.

Pros and Cons of Flat-rate Pricing

Pros:

- It gives you a regular, stable income, which makes it easy to plan your budget.

- With a simple pricing structure that’s easy to understand, it’s easier to make good business decisions.

- Flat-rate pricing makes it easy to add service levels when customer demand increases.

Cons:

- No flexibility for custom customers or more advanced use cases.

- Flat rates may not reflect value to all customer groups, which results in missed opportunities or churn.

- Flat-rate pricing may not be good enough for customers when their needs change and they need customized options.

How to Set Up Flat-rate Pricing in Stripe

Follow these steps to configure flat-rate pricing for your product in Stripe:

1. Create the Basic Product:

- Head over to the Product catalog and click + Add product.

- Enter the product name.

- (Optional) Add a Description—it will show at checkout, in the customer portal, and in quotes.

- For more info on product creation options, visit the prices guide.

2. Set Up Monthly Pricing for the Basic Product:

- Click Advanced pricing options.

- Click Recurring and choose Flat rate for the pricing model.

- Enter the price amount (e.g., 15.00).

- Select Monthly as the billing cycle.

- Click Next to save this price.

3. Set Up Yearly Pricing for the Basic Product:

- Click + Add another price.

- Select Recurring and choose Flat rate for the pricing model.

- Enter the price amount (e.g., 90.00).

- Choose Yearly for the billing period.

- Click Add product to save the product with monthly and yearly prices. You can change the product and price later if you like.

4. Integrate the Subscription:

- See the subscription integration guide for full integration instructions.

5. Configure Checkout or Customer Setup:

- If you are using Stripe Checkout, now it’s time to set up a Checkout session for your website and set up Stripe.

- If you are using Stripe Elements, then create a Customer and set up Stripe and sample applications.

Best Practices for Implementing Flat-rate Subscription

1. Define Clear Value for Each Tier

Make sure that every flat-rate level offers special benefits that fit the specific customer needs. Distinguishing your offer makes it easier for customers to know why they should buy or renew.

2. Bundle Features Strategically

Group features within each tier by customer requirements and expected use cases. The idea is to make each level’s content interesting and valuable without overwhelming customers.

3. Price Test with Target Audiences

Test different price points with segments to see what is the right value for the customer, as well as the revenue. By testing you will discover the sweet spots for pricing that lead to the highest conversion and retention rates.

4. Track Customer Churn and Upgrade Patterns

Use Stripe’s analytics to track which tiers see the most churn or upgrades. Figuring out what tiers are best (and why) can help you adjust your price points or get features in line with customers’ demands.

5. Optimize Communication Around Benefits

Explain clearly in all marketing communications what’s included with each plan and how those benefits assist the customer. Good communication prevents ambiguity and helps customers make informed purchases.

Per-seat Pricing

Per-seat pricing is a subscription type where companies charge customers for the number of users, seats, or licenses needed for a service. It is a standard method for SaaS products, collaboration applications, and other multi-user applications. This is because companies can easily increase or decrease pricing based on the growth or usage of their users. Per-seat pricing works in the favor of both the provider and the customer. While it gives businesses an adaptable solution that evolves with customers’ needs, it also allows customers to pay only for the exact number of users they need.

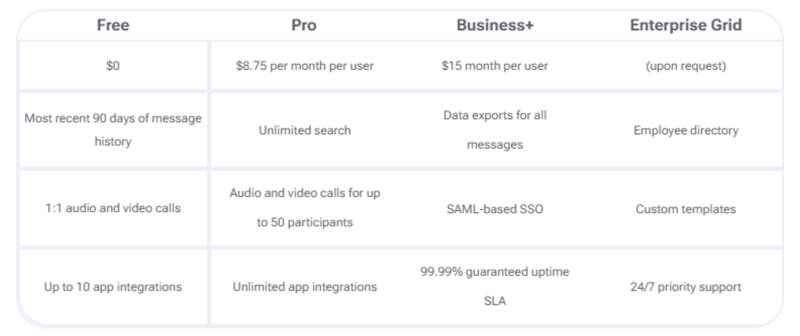

Slack, a team communication tool, uses per-seat pricing. Every business pays per active user. This means that they only pay for employees who are actively using the tool. If, for instance, you have 100 employees but only 60 users, the business only charges for the 60 seats which is cost-effective and fair. Slack has different levels of features that companies can opt for based on their needs, but the per-seat price remains the same.

Use Cases of Per-seat Pricing

- Team Collaboration Tools: Software where each additional team member (seat) increases the overall value (e.g., project management tools like Asana or Slack).

- Enterprise SaaS Solutions: Apps that are useful to larger groups or departments like CRM software (e.g., Salesforce).

- Learning Management Systems (LMS): Platforms where schools or businesses pay per learner, especially common in e-learning platforms.

Pros and Cons

Pros:

- Prices change as the number of customers increases, which makes it great for expanding companies.

- The clients only pay for the seats that they need which is cheaper.

- Revenue is easy to predict as new users register.

Cons:

- Per-seat fees might be unclear to the customer, especially in large teams.

- As the teams downsize, they can lose seats, resulting in a loss of monthly revenue.

- It’s not as effective for businesses targeting small teams or individual users.

How to Set Up Per-seat Pricing in Stripe

- Define Your Product: In the Stripe Dashboard, go to “Products” and create your core product, making it clear this is a per-user or per-seat plan.

- Configure Price Per Seat: Set up a Price object that defines the cost per seat and links it to the product. In Stripe’s API, configure the pricing plan to calculate total costs based on the seat count.

- Integrate Usage Tracking: Stripe allows dynamic pricing based on usage, so businesses can connect their user data to Stripe and adjust the price as seats are added or removed. Use webhooks to automatically update billing in real-time.

- Use Stripe’s Billing API: Integrate Stripe’s Billing API to automate billing calculations and adjustments based on seat changes.

How to Set Up Per-Seat Pricing in Stripe

To implement a per-seat pricing model using the Stripe Dashboard, follow these steps:

1. Create the Per-Seat Product:

- Head over to the Product catalog and click + Add product.

- Input product name.

- (Optional) Add a Description—this will show at checkout, in the customer portal, and in quotes.

- For more information on creating products, check out the prices guide.

2. Set Up Monthly Pricing for the Product:

- Choose Recurring as the pricing type.

- Enter the price amount (e.g., 50.00 per seat).

- Choose Monthly as the billing period.

- Click Add product to save. You can revise the product and pricing later on.

3. Create a Subscription Using the Per-Seat Pricing:

- Navigate to Payments > Subscriptions.

- Click + Create subscription.

- Find or add a customer for the subscription.

- Find the Per-seat product and choose the price plan you want.

- (Optional) Enable Collect tax automatically to use Stripe Tax.

- Choose Start subscription to activate right away or Schedule subscription to activate at a later time.

4. Integrate the Subscription:

- Please see the subscription integration guide mentioned earlier for detailed integration instructions.

5. Set Up Checkout or Customer Creation:

- If using Stripe Checkout, create a Checkout session for your site and configure Stripe.

- If you are using Stripe Elements, create a Customer and configure Stripe and the sample application.

Advanced per-seat pricing setups (dynamic pricing or tiered models): See advanced

For more advanced per-seat pricing configurations, such as dynamic pricing or tiered models, refer to the advanced models section.

Best Practices for Implementing per-Per-seat Pricing

1. Define User Tiers Clearly

Be clear about pricing when you add more seats and share this with onboarding and billing. For example, offer tiered discounts like $10 per seat for the first 10 users, and $8 per seat for 11–50 users. Clear tier definitions enable customers to understand costs and encourage larger teams to sign up.

2. Automate Seat Management

Use Stripe’s API to automate seat and bill generation. This also gives customers a live view of their invoices as seats are added or removed. Automated seat management eliminates manual errors and builds trust with the customer through seamless and accurate billing.

3. Offer Bulk Discounts

You can get more teams to sign up by offering seat discounts. Give, for instance, 10% off for teams over 50 users. Bulk discounts make per-seat pricing attractive to large businesses and can drive adoption among enterprise customers.

4. Highlight Scalability Benefits

In your marketing and onboarding, highlight how per-seat costs vary with team size. For instance, show how easily companies can add 5 seats and grow to 50 as their staff grows. Placing per-seat pricing as a scalable option appeals to growing teams and startups.

5. Track Customer Usage Patterns

Track how visitors add or remove seats in real time and learn more about their preferences. You can use this information to adjust your pricing model, introduce volume discounts, or drive retention. If, for example, users tend to empty seats during off-peak times, you could offer seasonal pricing plans.

Usage-based Pricing

Usage-based pricing, also known as pay-as-you-go or metered billing, charges customers according to how much of a product or service they use. This model is common with enterprises who have variable-demand products like data storage or API consumption where the demand changes with the customer. Usage-based pricing allows businesses to match costs to the usage, which is attractive for customers who prefer to only pay for what they actually use.

Stripe supports usage-based pricing through its Stripe Billing API, which enables businesses to implement and manage this model efficiently. With Stripe’s metered billing capabilities, businesses can track customer usage in real-time and bill accordingly at the end of a billing cycle. For example, a SaaS company offering an API can record API calls using Stripe’s metered billing API, calculate the total usage, and generate an invoice automatically.

Use Cases of Usage-based Pricing

- Cloud Storage and Computing Services: Companies like Amazon AWS and Google Cloud, where customers pay based on data storage or computing power.

- API Services: Platforms like Twilio and Stripe itself, where pricing is based on the number of API calls or transactions.

- Telecom and Utility Providers: Internet service providers (ISPs) and phone companies that bill based on data usage or minutes consumed.

Pros and Cons

Pros:

- Customers love only paying what they need, so cost is relative to benefit.

- Accommodates customers with varying needs, promoting customer satisfaction.

- Customers can get started on a small amount and scale consumption accordingly.

Cons:

- Revenue can be hard to predict reliably, because of variable usage.

- Accurately tracking and billing usage requires robust infrastructure, which isn’t always possible for small enterprises.

- Some customers will complain about exorbitant charges, so it is essential to be transparent.

How to Set It Up

Follow these steps to configure usage-based pricing for your product in Stripe:

1. Create the Product:

- Navigate to the Products tab in your Stripe Dashboard.

- Click + Add product.

- Enter the product name.

2. Add a Recurring Flat Fee Price:

- Choose Flat rate pricing as the pricing model.

- Set the flat fee amount (e.g., 150 USD).

3. Add a Usage-Based Price:

- Add a second recurring price to the product.

- Select Usage-based as the pricing model.

- Choose Per Tier and Graduated for the pricing structure.

- Define pricing tiers:

- Set the initial level at 0 USD for the first 100,000 units as it is part of the flat rate.

- Create more tiers with graduated prices based on usage beyond 100,000 units.

4. Create a Meter for Usage Tracking:

- Create a new meter to record and track the usage of the product.

Best Practices for Implementing Usage-based Pricing

1. Define Usage Units Clearly

Set a clear unit of measure for your usage-based pricing system, whether it is API calls, gigabytes, or minutes. Give exact definitions in your pricing paperwork and invoices to avoid confusion or dispute. Have definitions on your website or in the billing interface so customers know how charges are applied.

2. Set Usage Alerts

Automate notifications when a customer reaches or exceeds usage thresholds. Send an email or app message for example when a user reaches 80% of their limit. This is a practice that helps avoid surprise charges, builds trust, and gives consumers control over consumption.

3. Provide Transparent Billing Reports

With Stripe’s reporting, you can include consumption data on the invoices so customers know exactly what they’re being charged for. If a customer is invoiced by API call, the invoice should show API calls and the total cost. This openness gives customers peace of mind and reduces billing support calls.

4. Encourage Trial Periods for New Users

Give trial periods or usage caps for new customers to try out your service without spending money. For instance, you could give free access for up to 10,000 API calls in the first month. It creates trust in your offering and also motivates customers to move to paid usage billing plans.

5. Offer Volume Discounts

Promote higher usage with bulk or volume discounts. For instance, charge $0.01/unit for the first 1,000 units and $0.08/unit above 1,000. Volume discounts drive higher adoption and reward repeat/regular users which further boosts the long-term potential.

Subscription with Add-Ons

A subscription with add-ons allows companies to provide a base service or product that consumers subscribe to, and additional options or features that they can purchase as add-ons. This model is perfect for companies that would like to offer a more customizable service where customers can choose a base package and later purchase features or services as needed. The add-ons are usually charged at a separate rate from the base subscription, and subscribers may add them at any time during the subscription period.

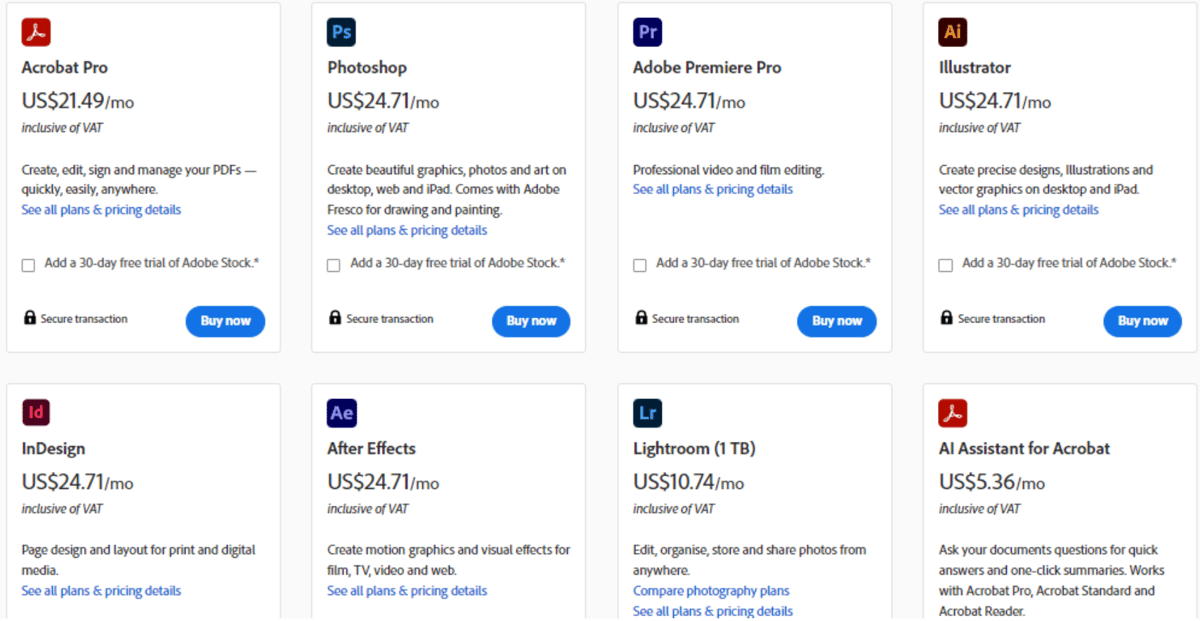

Adobe Creative Cloud is an add-on subscription service that gives you a basic plan with the flexibility to add applications or services. The service has a base plan that comes with core creative tools such as Photoshop and Illustrator, then you can supplement it with special features. This gives customers the option to begin with a base package and upgrade their subscription according to their creative needs.

Use Cases

- SaaS Platforms: Where users pay for a base plan and then buy the additional storage, premium support, or more users.

- E-commerce Subscriptions: Subscription boxes where customers receive a basic monthly box and can add extra products for an additional cost.

- Telecom Services: Customers pay for a standard mobile package but can add international calling, data plans, or device protection.

- Media and Content Services: Services where customers subscribe to a base content library and purchase additional channels, movies, or special content.

Pros and Cons

Pros:

- Customers can build their subscriptions exactly as per their needs and only pay for what they want.

- By selling add-ons, companies can drive higher average revenue per user (ARPU).

- Businesses can tailor their services to different customer profiles, catering to low-income customers and high-demand clients.

Cons:

- With multiple add-ons, invoicing can become cumbersome and you will need to keep track of everything.

- If you add too many add-ons, customers will get confused and bored.

- If a customer no longer needs the add-ons, they might cancel the entire subscription, leading to churn.

How to Set It Up

Study this guide on multiple-product subscriptions to learn how to create subscriptions with multiple products.

Best Practices for Implementing Subscription with Add-ons

1. Offer Clear Add-On Choices

Make sure you have clear add-ons, concise descriptions, and affordable pricing. The end-user must know quickly what each add-on does and is useful for. List features, benefits, and use cases on your price page to avoid misunderstandings and help customers make informed choices.

2. Limit the Number of Add-Ons

Variety is important but when there are too many choices, customers will find it hard to make a decision. Make sure to provide a custom selection of relevant add-ons to go along with your core offering. For example, give attention to the features customers ask for the most.

3. Bundle Add-Ons in Packages

Bundle complementary add-ons in discounted bundles to sell more. For instance, a cloud service could provide managed services and development tools at a discounted price all in one. It makes it easy for customers to make decisions and also gives them more value and revenue per subscription.

4. Highlight the Benefits of Add-Ons

Make use of marketing campaigns and in-product push notifications to show how different additions complement the core product. Show examples of use cases, such as the productivity enhancements of a high-end analytics platform, or testimonials from previous users. When your value proposition is explicit, it makes it clear to customers that there’s real value in upgrading subscriptions.

5. Provide Flexible Billing

Always separate recurring from one-time add-on fees so that users are not confused. When a customer purchases a one-time upgrade, mention this in the invoices and confirmations. Clear billing enables trust and avoids customer service calls which makes for a better user experience.

Key Factors to Consider When Choosing a Subscription and Payment Setup

Choosing the correct subscription or payment setup is essential for companies that want to provide a frictionless experience and bring in more profits. The following are some of the most important things to consider:

1. Target Audience and Usage Patterns

Study your competitors to see if a given pricing model is common in your industry. For instance, usage-based pricing is the norm in SaaS such as Slack, Twilio, and Amazon Web Services (AWS). But flat pricing is popular with streaming services such as Netflix, Spotify, and YouTube Premium.

Consider how customers will normally use your service. If they need flexibility, then an add-on model or per-seat pricing might be good as that allows the customer to change their plan as they evolve.

2. Revenue Predictability vs. Scalability

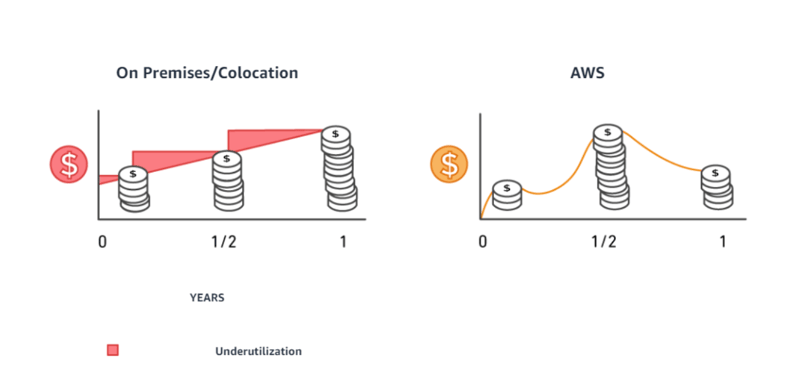

If you want a reliable, predictable revenue stream, flat-rate subscriptions, such as those offered by Spotify, ensure consistent monthly income. Conversely, for companies aiming for scalability, usage-based models like AWS allow businesses to grow as customer demand increases.I

Consider whether you’re more focused on attracting customers or generating the most revenue. Flexible pricing models (like per seat and usage-based pricing) can attract customers who initially may only use a small amount and gradually grow up to scale the business.

3. Billing Complexity and Operational Resources

Simpler models, such as flat rate or per-seat pricing, are easier to operate and explain to users. Higher-level or add-on-oriented models can mean more complex billing and customer care.

Complex billing models such as tiered or usage pricing might require higher-level systems to correctly monitor and regulate usage. Make sure that your staff has the time or technical skills to set up and operate these systems.

4. Ease of Integration

Choose a model that works with your current technology stack. Stripe’s API can handle several models, however, sophisticated configurations might need some more developer assistance.

If you are short on technical capital, then the easier models are more fast and simple to implement. Stripe’s integration guides can help ensure that advanced models integrate with your current systems.

Common Challenges Businesses Face with Stripe

Stripe is an efficient online payment system but there are some problems businesses face when working with it. These include:

1. Sudden Account Suspension

For subscription-based businesses, account suspension can have a more severe impact, as recurring payments from subscribers may be interrupted, leading to lost revenue and customer churn.

Stay compliant with Stripe’s policies and be transparent on all payments. Check Stripe’s terms of service frequently and have internal rules for employees to prevent unintentional infractions.

2. Sudden Fund Freezes

In subscription models, where payments are automatically processed on a recurring basis, a sudden freeze on funds can disrupt not only cash flow but also customer relationships. Funds held by Stripe could delay the fulfillment of subscriptions, resulting in service interruptions or cancellations.

Stripe has sophisticated fraud prevention features. Watch transaction reports frequently, stay current, and report to Stripe support if you have any suspicions that legitimate funds are being held.

3. Chargebacks and Dispute Management

Chargebacks can be especially detrimental for subscription businesses because they often involve recurring payments, which means multiple chargebacks can accumulate over time.

If you want to avoid chargebacks, you need to know what your charges are, have clear policies, and have good customer service. Activate Stripe’s Chargeback Protection program for extra protection.

4. Limited Customer Support

Although Stripe has extensive documentation, businesses often report challenges when accessing direct support for more complex or urgent issues, which can delay resolution.

For faster support, explore Stripe’s Enterprise support options if applicable, or use the developer community for troubleshooting. Create a plan for escalating urgent issues internally.

5. High Transaction Fees for International Payments

For subscription businesses with a global customer base, high international transaction fees can significantly reduce profit margins, especially when subscriptions are charged regularly in different currencies. These costs accumulate over time and impact long-term profitability.

Check Stripe’s international fees before going global, and find other payment solutions for certain countries to handle the costs.

6. Difficulty with Integration for Custom Use Cases

For subscription businesses with complex billing requirements, such as tiered pricing, or advanced features like subscription with add-ons billing, integrating Stripe’s API may take months and require specialized development resources.

Hire or talk to developers who know Stripe’s API. Follow Stripe’s integration guides to streamline deployment and evaluate your custom use cases in the sandbox before deploying.

7. Limited Functionality for Subscription Management

Stripe provides some basic subscription functionality but if you have complex subscription needs like variable billing periods or your own customized alerts, you may need some extra tools.

Install third-party plugins or Stripe’s robust API features to run custom subscriptions. Plugins such as Chargebee or Recurly also add subscription management capabilities if Stripe’s built-in options are restrictive.

8. Payout Delays

Businesses sometimes have to wait a bit for payouts due to Stripe’s risk-management policy if they’re involved in lots of disputes or high-value transactions.

Keep your account in good shape, with a low number of chargebacks and disputes. Understand Stripe’s payout schedules and set reasonable cash flow expectations.

The Takeaway

With flexible Stripe pricing (whether flat rate, usage-based, or add-on subscriptions), companies can customize their product to cater to customer needs and market trends. By choosing a subscription model that works for your business and taking advantage of Stripe’s powerful tools, companies can develop a scalable, secure, and fast payment ecosystem.

To maximize the benefits of Stripe, it’s important to evaluate your business’s needs carefully and select the model that best supports growth and customer engagement. With the right setup, you can streamline your payment process, minimize complexities, and enhance the overall customer experience.