Running a successful business depends on collecting data to analyze business performance and make necessary timely changes. All businesses require metrics to track their performance, but the type of business metrics used depends on their nature.

No matter your business, you need to make a living to support yourself. So you have to use metrics that let you track your revenue performance. However, focusing on revenue isn’t enough to establish a sustainable, successful business.

What other factors should you track? How can you narrow them down? And how can you come up with metrics to gain meaningful insights? Keep reading to find answers to these questions.

What Are Business Metrics?

“Successful businesses measure what matters, but they don’t just stop at revenue. Knowing where to pivot, adjust, or double down comes from tracking a range of metrics across every corner of the operation”

Jacek Głodek

The term “business metrics” is often used by managers, but many people don’t understand what it represents.

Business metrics are quantitative numerical measures that represent, monitor, analyze, and track the progress or decline of a business. They can quantify almost all aspects of a business, such as marketing, production, customer satisfaction, and revenue.

These metrics are also helpful in understanding business performance because they make business analyses more substantial and objective.

However, figuring out which business metrics to use can be tough at the beginning because there are various metrics you can use to understand business performance. This is why it’s essential to be aware of most of them.

Learning about business metrics can help you choose the most suitable requirements and priorities for your business. It also allows you to monitor and use your business plan to achieve all short- and long-term goals.

The Most Important Business Metrics to Track

Some metrics work for all businesses despite their differences. Here are some examples of essential metrics you should be tracking:

1. Sales Metrics

The goal of a successful business is to increase the number of sales to maximize overall revenue. Sales metrics track these crucial numbers, helping you get the most ROI and ROAS and ensuring your business can survive long-term in the competitive market.

These metrics also give you an overview of your business’s health, as all business aspects are, in most ways, designed to generate more sales.

The following metrics are used to track the performance of sales:

Sales Win Rate

Not all leads encountered by the sales team can be converted into successful sales. But it’s important to continue striving to convert more potential leads into actual sales. You can do that by keeping track of the sales win rate.

The sales win rate is a percentage of leads converted into real sales by the company’s sales team. The formula used to calculate it:

Sales Win Rate = (No of Potential Sales/Actual Sales) x 100

If this percentage decreases over time, it indicates that your sales methods aren’t working as efficiently, and you need to introduce changes to maximize sales.

Sales Cycle

The sales cycle is the time it takes for the sales team to complete a successful sale from start to finish. It helps the team track how efficiently sales are being made and allows them to make plans to reduce the cycle length as much as possible.

The cycle’s length directly impacts the sales team’s ability to meet their targets, so it needs to be closely monitored. For example, if your team’s cycle length is unnecessarily long, it reduces the overall time your team has to meet their targets.

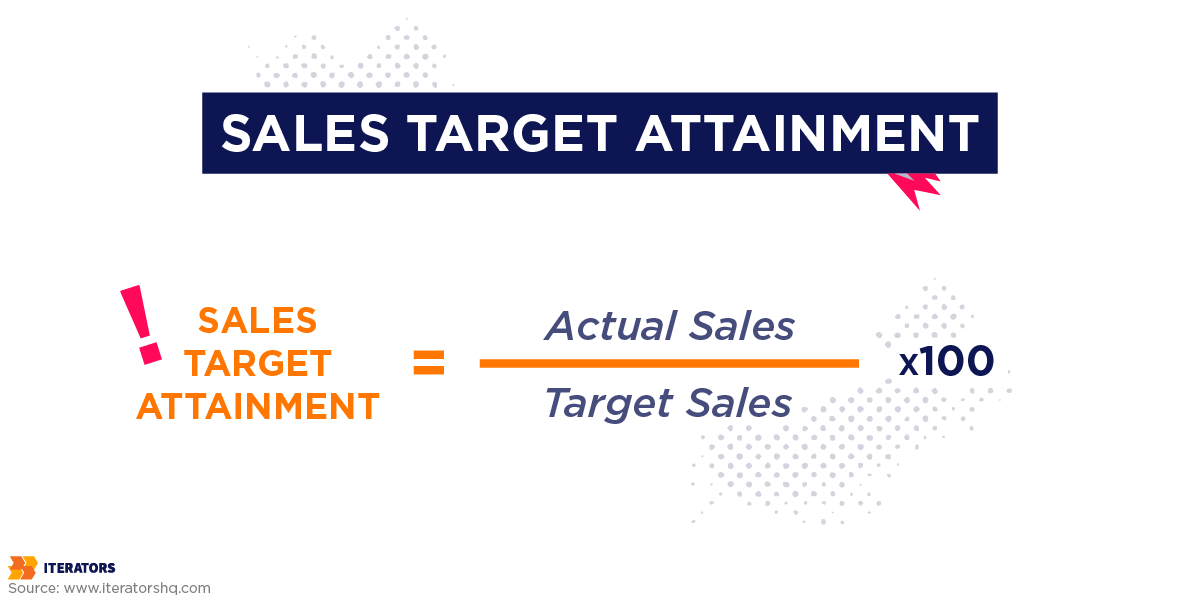

Sales Target Attainment

All sales teams discuss and decide on a target number of sales they expect to make in a given period, like a month, a quarter, or a year. The target is based on a business’s financial goals, has to be at least above the sustaining cost of the business, and should create enough profit to help the business thrive in a competitive environment.

The sales target attainment percentage is calculated using the following formula:

Sales Target Attainment = (Actual Sales/Target Sales) x 100

If your sales team is able to meet the target in the decided period, then it means the bar was set too low, and the team has the potential to generate more sales. So, the target should be raised for the next cycle.

On the other hand, if the team can’t reach 60 to 70% of the target sales, then the goal is unrealistic and needs to be revised, or if the target is non-negotiable, then changes have to be made to the sales strategy to get effective results.

2. Financial Metrics

A business’s financial health needs to be monitored to ensure that losses are minimized, assets are maintained, liabilities are reduced, and profitable revenue is generated. The following metrics will help you achieve that:

Total Sales Revenue

The total sales revenue is the total amount of money generated from the sales in a given period. It’s a core financial metric because a business’s lifespan depends on generating revenue, so it goes without saying that all businesses have to keep a close eye on it.

If the revenue at any point is insufficient to sustain the cost of running a business, it will inevitably have to shut down.

This metric is relatively easy to calculate, and it could be done with the help of a simple Excel sheet as well. However, it becomes slightly complicated if a business sells more than one service or product with a significant price differential.

Overhead Costs

Overhead costs are essential expenses required to be covered to run a business. These expenses are independent of sales or service production. They have to be paid no matter what.

So keeping track of overhead costs is vital to understanding the amount of capital required to keep a business functional. Rent, employee salaries, and electricity bills are some examples of these necessary expenses.

Keeping track of these expenses also lets you know how much of your revenue is being used to pay for them and where these costs can be cut to reduce expenses. It also helps you decide what the target revenue should be to be able to generate more profit.

Variable Costs

Aside from overhead costs, businesses have other expenses related to production, manufacturing, and delivery of the final product. These are labeled as variable costs because they vary based on product type, production cycle efficiency, and other factors.

It’s important to track variable costs to have room in your budget and be prepared to deal with them appropriately. These costs increase with an increase in production.

However, if you scale production according to product demand, you’ll increase sales and easily cover variable costs.

Gross Profit Margin

Gross profit margin is a fundamental financial metric used by all businesses because making a profit is their eventual goal. This measure is an overall reflection of how well you have managed your costs and sales revenue.

The gross profit margin percentage can be calculated using the following formulae:

Gross Profit = Revenue – (Overhead + Variable costs)

Gross Profit Margin = (Gross Profit / Total revenue) x 100

By calculating the gross profit margin percentage, you can understand the amount of profit you’re making in regard to your sales. The higher the margin, the better it’s for your business, which means you are making a decent profit per sale.

This might lead you to wonder what a good profit margin is. Well, that varies and depends on the type of your business.

A 50 to 70% gross profit margin is considered healthy for most businesses producing products. However, this margin is considered incredibly low for the service industry.

Service businesses like IT and law firms expect a gross profit margin of 70 to 90% because they have low overhead and variable costs.

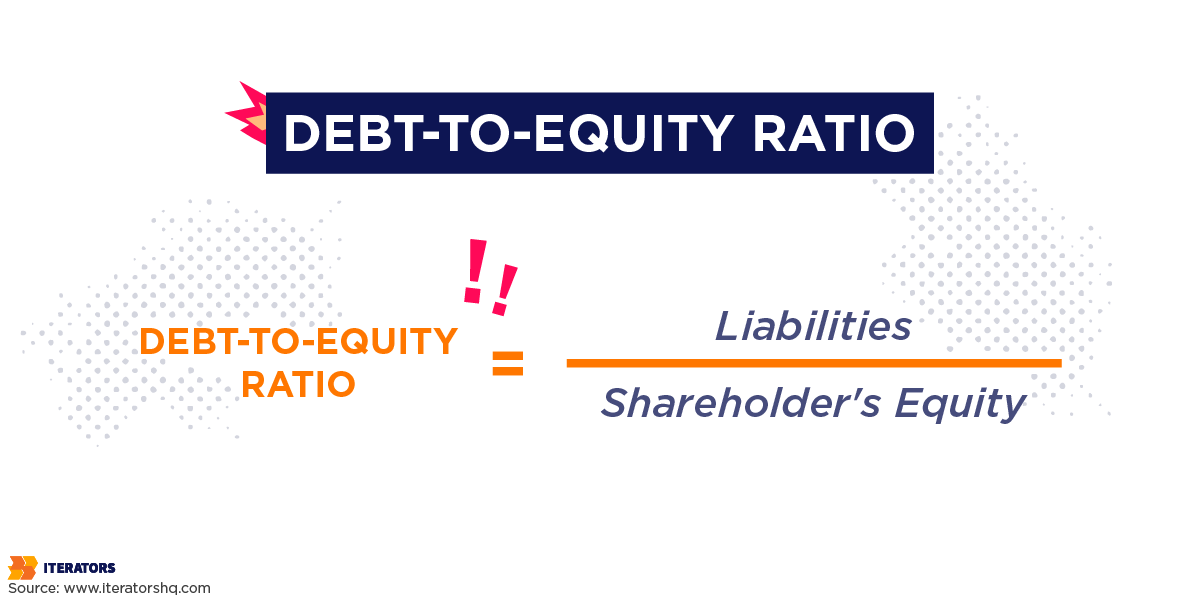

Debt-to-Equity Ratio

The debt-to-equity ratio is one of the most crucial financial ratios used to evaluate a company’s overall financial health. It provides insight into how a business sustains itself by comparing its liabilities to its assets.

The ratio is also strongly correlated with the size of the company, so it increases with the size of the company. It can be calculated using the following formula:

Debt-to-Equity Ratio = Liabilities / Shareholder’s Equity

Your debt and equity should be equal in an ideal ratio of 1. However, this is rarely the case, and the ratios are typically higher than 1. Therefore, anything above 1 would indicate that the business’s liabilities exceed its assets.

A lower debt-to-equity ratio is desirable because it shows that a business can finance itself using its assets and not completely rely on its creditors for longer. Plus, if your company needs investors, a lower ratio will encourage investors to provide funding because it indicates reduced investment risk.

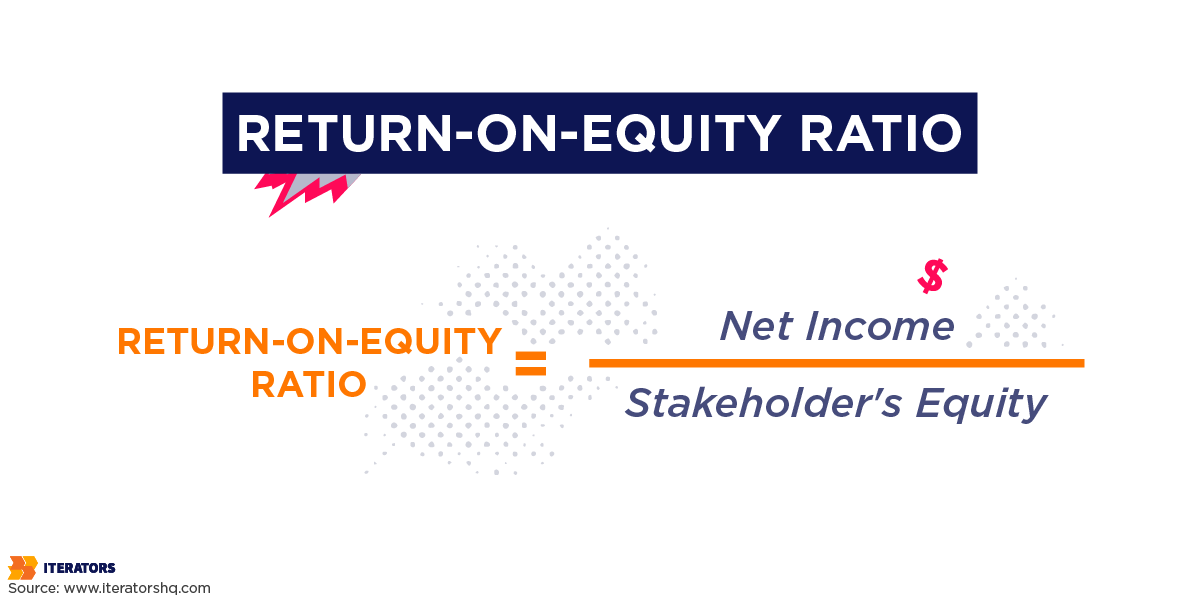

Return-on-Equity Ratio

The return-on-equity ratio is an essential metric for investors because it indicates the return on the investment they’ve put into a company. It reflects how profitable the investment is and how well a company uses the investors’ equity.

It can be calculated by using the following formula:

Return-on-Equity Ratio = Net Income / Stakeholder’s Equity

The greater the ratio, the more profit the stakeholder will make from their investment. Lower ratios will mean the investment isn’t profitable, and the stakeholders should reflect on whether or not they want to continue investing funds.

The ratio also tells businesses where they stand, allowing them to take the necessary measures to increase business sustainability.

3. SaaS Metrics

Software as a service (SaaS) is a model that has recently been on the rise because of the rapid growth in the IT industry.

SaaS is a service that delivers applications over the internet. By using it, you won’t have to invest your time and energy in figuring out complex software and hardware management. You can just simply access them over the internet via a third party.

To monitor and maintain the success of the software industry, IT businesses had to come up with several metrics. Here are some of these metrics:

Customer Churn

The long-term goal of an IT business is to retain customers and lose as few of them as possible. This can be achieved by paying attention to those who decide to leave.

As most software businesses rely on subscriptions, counting the number of customers leaving is easy. You just have to calculate the number of canceled subscriptions, which equals the number of customers lost.

You can also further look into the personas of your customers and figure out what caused them to leave if you want to retain similar customers in the future. A low churn rate is an ultimate goal.

Gross Burn Rate

More often than not, SaaS businesses are startups, so they rely heavily on investments and funding to keep functioning. In these situations, it’s essential to track how quickly they can utilize capital to arrange for more funds if needed or consider cutting costs to survive.

The amount of cash used monthly by a business is called the gross burn rate, commonly used to assess the business’s financial health. The gross burn rate can be calculated by adding all the company’s expenses, e.g., employees’ salaries, rent, and all other overhead costs.

Monthly Recurring Revenue (MRR)

Most businesses in the SaaS industry follow the subscription model to generate revenue. These subscriptions are usually monthly so that customers aren’t overburdened and can afford to avail of them.

As revenue is generated from these subscriptions, it’s important to calculate the recurring revenue per month to understand business finances and to get insights into how satisfying the service is for customers.

The monthly recurring revenue (MRR) can be calculated using the following formula:

MRR = Average Subscription Amount x Number of Subscribers

If the MRR increases, it means the number of subscriptions has increased, but if it decreases, it is a cause for concern because it indicates your customers are unsatisfied. In the latter case, you’ll have to address root causes to stop other potential unsubscriptions from happening.

The MRR also gives you an idea of your potential monthly gross revenue for the next month so you can plan your expenses in advance.

4. Marketing Metrics

Marketers use marketing metrics to keep track of and monitor customer acquisition progress. Many marketing metrics can measure successes and failures, so it’s important first to set your goals and then choose the metrics that can help you track your progress.

Usually, marketing metrics vary depending on what you want to achieve. Here is a list of metrics that you can choose from:

Cost Per Acquisition (CPA)

Cost per acquisition (CPA) is the amount of money you need to spend if you’re looking for a new customer. This can vary depending on what type of business, time of the year, and so much more.

CPA can easily be measured by adding all the money spent on marketing and then dividing it by the number of customers acquired. It is always better to keep finding sustainable ways to lower your business’s CPA, such as marketing software.

Cost Per Lead (CPL)

Cost per lead (CPL) is the money spent to bring in new leads to convert more customers. It helps businesses with adjusting their budgeting, creating better goals, etc.

CPL can be calculated by adding up all the amount spent on marketing divided by the total number of new leads added. These calculations should be done at least once a month.

Customer Lifetime Value (CLV)

Customer lifetime value (CLV) is the total amount a customer has spent on your business. It includes all the money from their first purchase to the last one. These calculations are done according to your pricing model.

CLV explains that marketing campaigns should be aimed at turning good customers into regular customers. It’s calculated by multiplying the average customer value by the average customer lifespan.

Click-through Rate (CTR)

Click-through rate (CTR) is the number of times an ad, link, or website was convincing enough that it was clicked in comparison to the number of impressions achieved. If the CTR is high, then the placement of ads and links is done right. If the opposite is true, you need to make changes.

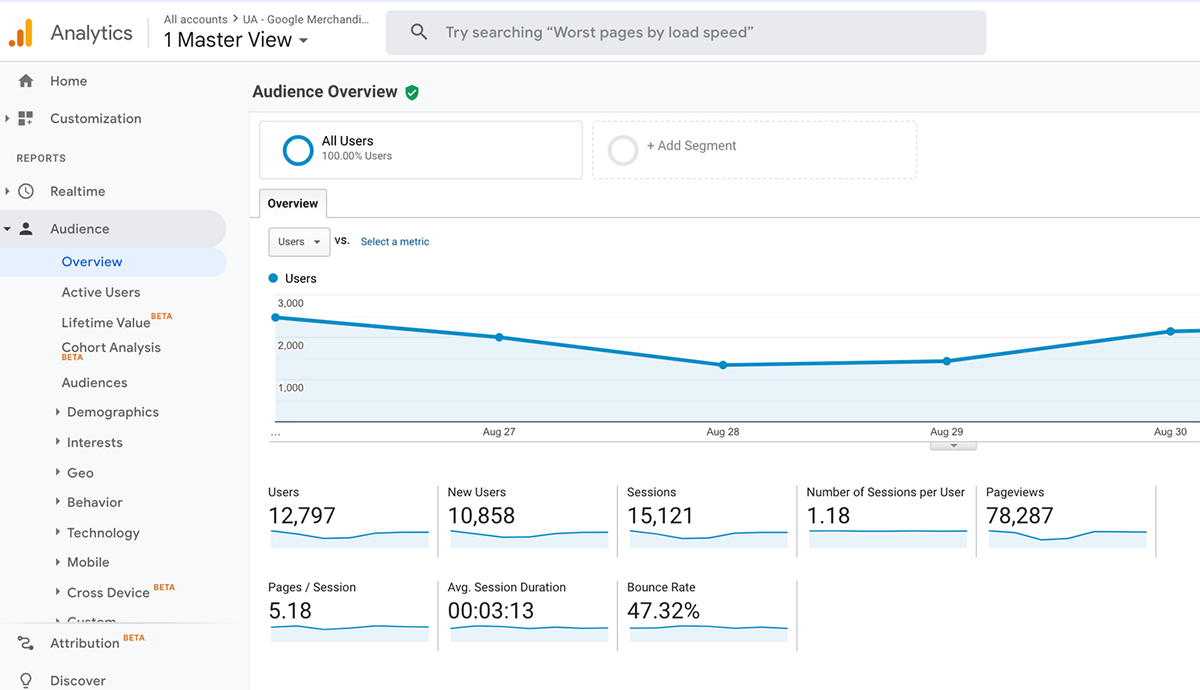

If the platform you’re using doesn’t provide marketing data for free, you can always use a calculator like Google Analytics to calculate your CTR by manually entering the number of clicks and impressions your ad or post got.

Bounce Rate

The bounce rate gives you the percentage of the people who checked out your website and left right away. A high bounce rate indicates that your website isn’t convincing enough or appealing enough for the customers to stay.

If you’re interested in calculating your bounce rate, you can easily do that by using website analytics tools like Google Analytics. Your aim shouldn’t be to achieve a 0% bounce rate because that isn’t possible. A bounce rate below 40% is considered successful.

Business Metrics vs. Key Performance Indicators (KPI)

You might have observed that many people use the terms “business metrics” and “KPIs” interchangeably, making it challenging to separate the two and focus on how they are different. This makes it crucial to understand what they are.

A metric is a quantifiable numerical value that evaluates, tracks, monitors, and measures business performance. In contrast, key performance indicators (KPIs) are standards or criteria internal or external teams set to assess business progress.

KPIs use business metrics to show business growth. This is where most people get confused.

Here’s the thing: business metrics measure a business’s overall health and quantify it. In contrast, KPIs use these metrics to track progress toward a specific target on a particular timeline.

For instance, if the manager of a company wants to track their business’s strategic priorities, there are a few management KPI examples they can use, such as gross margin, roe (return on equity), customer satisfaction score, operating margin, etc. These KPIs will help them understand their business financials and the effect they’re having on their market.

In the above example, the manager uses already tracked business metrics and integrates them into KPIs to track their progress over a specific period.

Aside from that, KPIs also consist of many other features used to monitor targets and aren’t limited to just using business metrics. Therefore, it’s understandable why people find it hard to separate them, but the two are, in fact, distinct and used differently.

How Do Business Metrics and Key Performance Indicators (KPIs) Compare?

The following table will help you compare the differences between business metrics and KPIs, as well as understand their benefits:

| Business Metrics | Key Performance Indicators |

| It measures the overall health of a business. | It targets the performance of a specific department or area of a business. |

| It tracks performance without a specific goal. | It tracks performance with a specific purpose. |

| It’s usually measured in regular pre-decided intervals. | It follows a specific timeline to achieve a goal. |

| It may or may not provide actionable insights. | It provides vital, actionable insights. |

Benefits of Tracking Business Metrics

There are several benefits of tracking business metrics, such as:

1. Evaluating the success of a feature already in progress

By monitoring user activity, we can determine whether the functionality we just introduced is successful.

And if the functionality is not yet fully implemented, A/B Testing helps in making design decisions.

2. They Allow You to Identify Trends and Problems

Regularly tracking crucial metrics allows your company to notice sales and revenue trends. These trends are important because they can provide insights into business performance and help you identify problem areas, allowing you to improve them.

For example, suppose your sales began to decline after you made changes to your offer. In that case, business metrics can help you identify the problem areas in your new offer and correct them to increase conversions again.

3. Metrics are a great extension to qualitative research

In an ideal world , when we want to gather the necessary information at the discovery stage we conduct quantitative and qualitative research. With the order taken, we can get different results.

When we first focus on quantitative research in the report we can include information in how large a group our respondents represent. This way we know how many other users have similar problems and pains in our product.

We can also take the second path. Start with quantitative research and deepen it with qualitative research. This allows us to understand how and why our respondents take action in a particular area.

4. They Improve Performance

After identifying problem areas through business metrics, you can evaluate your mistakes and make changes to repair the damage before it becomes irreversible.

Identifying problems is also a learning experience and decreases the likelihood of you repeating similar mistakes. It also provides you with a checklist that helps you know when things are going wrong.

5. They prioritize tasks with limited resources

Regular monitoring of results helps you make business decisions about the next activities to be undertaken. The analysis makes it easier to sort tasks into key and side tasks. It will work well when using popular methods such as Eisenhower (important/urgent) and MoSCoW, among others.

6. They Bridge Communication Gaps

Sharing qualitative insights with your stakeholders, employees, and customers gives them an understanding of where your business is headed.

The numbers seem to have a more significant impact on investors and stakeholders instead of business jargon they don’t care about. So, if they see increased revenue and profits, they will feel confident in their investment and might even feel encouraged to invest more.

Aside from that, sharing business metric-driven insights is also crucial for helping employees identify problems and areas they can work on.

7. They Help You Perform a Comparative Analysis

To survive in the competitive industry, you must continuously keep comparing the progress of your business with your competitors. You can do that by performing a comparative analysis. It can help you understand where you stand and how likely you’re to survive the competition.

Business metrics simplify a competitor comparison and prepare you for what you need to aim for. So, if you’re falling behind, they help you improve your targets and work towards meeting them.

But if you’re ahead of the market in your service category, they allow you to correctly identify what you’re doing and make it even better.

Conclusion

Business metrics are crucial in understanding business progress and providing actionable insights to improve business processes.

However, not all metrics are equal, and some are undeniably more important, so you should narrow down the ones that align best with your business goals. This way, you’ll be able to focus exclusively on your targets and achieve them as quickly as possible.

It’s a good idea to share the information gained from reports, as their data can be useful to other departments such as marketing. Publishing the results of your work, especially about the successes achieved, backed up by numbers can boost employee morale.